The Significance of Debt Service Coverage Ratio (DSCR) in Multifamily Finance in 2024

The Debt Service Coverage Ratio (DSCR) is a crucial metric in the world of multifamily finance as it plays a significant role in assessing the financial well-being of a property. As banking professionals with expertise in real estate and financial analysis, we recognize the crucial significance of DSCR in evaluating the feasibility and profitability of multifamily investments. In this comprehensive guide, we will discuss the details of DSCR, including its importance, calculation method, and impact on financing decisions in the multifamily industry.

Understanding Debt Service Coverage Ratio

The Debt Service Coverage Ratio is a financial metric used to assess a property’s ability to generate sufficient cash flow to cover its debt obligations. It provides lenders and investors with insights into the property’s capacity to meet its mortgage payments and other associated costs. Through the computation of the Debt Service Coverage Ratio (DSCR), bankers can assess the degree of risk involved in providing credit for a specific real estate asset.

How to Calculate Debt Service Coverage Ratio

The calculation of the Debt Service Coverage Ratio entails a simple formula. To calculate the Debt Service Coverage Ratio (DSCR), divide the property’s Net Operating Income (NOI) by the annual debt service, consisting of both principal and interest payments. The resultant ratio denotes the frequency with which the property’s cash flow fulfills its debt commitments.

Significance of Debt Service Coverage Ratio in Multifamily Finance

The Debt Service Coverage Ratio (DSCR) is a significant metric in the multifamily finance sector, impacting loan terms and lending determinations. A minimum debt service coverage ratio (DSCR) is usually required by lenders prior to providing financing, as it provides a level of confidence that the property generates adequate income to cover its debt obligations. A higher Debt Service Coverage Ratio (DSCR) indicates improved financial stability of the investment, thereby reducing the risk for lenders and investors.

Factors Affecting Debt Service Coverage Ratio

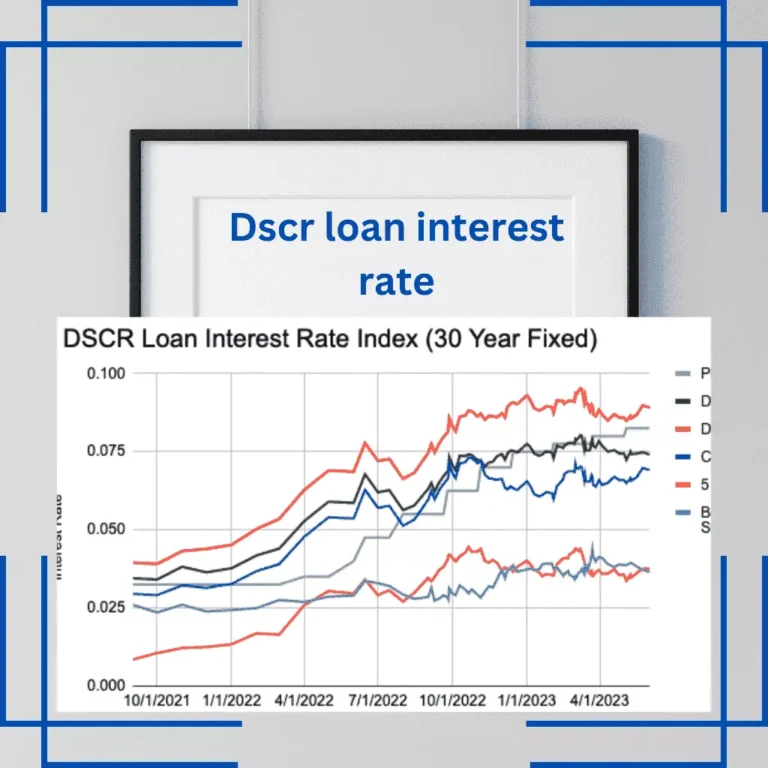

The Debt Service Coverage Ratio of a multifamily property is influenced by various factors. The key variables to consider are the rental income, operating expenses, vacancy rates, property management efficiency, and the current interest rates. A thorough comprehension of said variables enables investors to make informed decisions with regards to their investments and financing alternatives.

Benefits of a Healthy Debt Service Coverage Ratio

Maintaining a healthy Debt Service Coverage Ratio provides multiple benefits to proprietors of multifamily properties. First and foremost, it increases the property’s appeal to financial institutions, making it easier to obtain advantageous financing alternatives and favorable loan conditions. A higher debt service coverage ratio (DSCR) may result in reduced interest rates and higher loan amounts, allowing property owners to take advantage of their investments for additional expansion.

Additionally, a strong Debt Service Coverage Ratio (DSCR) inspires trust among prospective investors, indicating a secure and lucrative investment prospect. This has the potential to attract equity partners, thereby providing additional capital for property acquisitions or upgrades. Furthermore, a robust Debt Service Coverage Ratio (DSCR) can enhance the enduring viability and prosperity of a multifamily property, guaranteeing its profitability and feasibility.

Strategies to Improve Debt Service Coverage Ratio

There are various approaches that multifamily property owners can utilize to improve their Debt Service Coverage Ratio. Maximizing rental revenue by optimizing property management, executing expense reduction strategies, and minimizing vacancy rates are among the primary strategies. Regularly reviewing and optimizing the financial performance of the property is crucial to maximize cash flow and maintain a healthy debt service coverage ratio (DSCR).

Conclusion

The Debt Service Coverage Ratio (DSCR) is a crucial metric in multifamily finance that offers valuable insights into a property’s capacity to fulfill its debt obligations. Through a thorough understanding of the Debt Service Coverage Ratio (DSCR) and implementation of effective tactics to enhance it, real estate investors can fortify their investment portfolio, secure advantageous financing conditions, and guarantee sustained profitability.

![DSCR Loans in Michigan: Your Comprehensive Guide [2024]](https://loansformula.com/wp-content/uploads/2023/06/DSCR-Loans-in-Michigan-768x768.webp)