DSCR Loan Arizona (2023): A Comprehensive Guide

DSCR loans are an excellent choice for investors seeking for DSCR loans Arizona who want to acquire or finance rental properties in Arizona. These loans support real estate purchases by assessing the property’s ability to meet debt obligations based on cash flow and employing the rental revenue for mortgage qualification.

In the following article, we’ll go through the specifics of the DSCR Loan in Arizona, including how to apply for one that’s aimed at your investment goals.

DSCR Loan Arizona Requirements

DSCR loans offer fewer strict standards than typical loans, making it easier for individuals who do not want to give tax returns or pay stubs to apply without submitting substantial income documentation.

Good Credit Score (620 or Higher)

To be eligible for a DSCR loan, borrowers must have a credit score of at least 620. However, particular credit score criteria may vary based on the lender and the type of funded property.

Ensuring Positive Cash Flow

DSCR assists lenders in determining whether a property’s cash flow can satisfy loan repayments and borrower debt obligations. Positive cash flow means that income exceeds expenses, so ensuring lenders of the borrower’s capacity to satisfy financial obligations.

Property Documentation DSCR Evaluation

Borrowers must produce financial accounts and evaluations as proof that the property can achieve a Debt Service Coverage Ratio (DSCR) of 1 or higher.

The lender will need a rent schedule from you in order for you to determine the property’s fair market rent.

Property Appraisal: Estimating Rental Income

The valuation professional uses Fannie Mae form 1007 during the property appraisal process to calculate the expected rental income of the investment property.

This form provides a rent schedule that establishes the market rent for the property. The appraiser validates the property’s projected rental income in this manner.

Down payment

Investing in Your Property (20-25% Down payment): Borrowers commonly make a down payment ranging from 20% to 25% when pursuing a DSCR loan with a ratio of 1 or higher. The borrower’s commitment and financial capacity are demonstrated by this initial payment.

Lenders may still consider financing a property with a DSCR less than one. However, a greater down payment and potentially higher interest rates may be required. Borrowers can investigate financing options even if their DSCR falls below the acceptable threshold because of this flexibility.

How to Calculate DSCR When Seeking a DSCR Loan in Arizona?

Let’s look at an actual scenario to better grasp the DSCR loan calculation in real estate investment.

Jack is thinking about buying a rental property as an investment. The property costs $500,000, and he intends to put down 25%.

Property cost: $500,000

25% of $500,000 equals $125,000 down payment

Loan Amount: $500,000 minus $125,000 equals $375,000

Loan Specifications

The loan amount is $375,000

7.5% interest rate

20-year tenure

We can use the fixed-rate mortgage calculation to determine the annual mortgage payment (debt service):

Annual Mortgage Payment = Loan Amount / (1 – (1 + Interest Rate) (-Tenure))

(0.075 / (1 – (1 + 0.075) (-20))

Mortgage Payment Per Year = $33,073.95

Let’s get started on the DSCR calculation

Total annual rental income: $100,000

Annual vacancy losses: $10,000

Annual Operating Expenses: $40,000

Debt Service: $33,073.95 per year

Step 1: Determine your Net Operating Income (NOI).

Total rental income minus vacancy losses minus operating expenses equals NOI.

NOI = $100,000 – $10,000 – $40,000

NOI = $50,000

Step 2: Determine Total Debt Service (TDS).

TDS stands for Total Debt Service.

TDS = $33,073.95

Step 3: Determine the DSCR Ratio

Net Operating Income / Annual Debt Service = DSCR

DSCR = $50,000 / $33,073.95

DSCR = 1.51

The resulting ratio is the Debt-Service Coverage Ratio (DSCR) of the property.

The DSCR ratio is 1.51, meaning that net operating income exceeds yearly debt servicing by 1.51. This implies that Jack has a strong ability to earn income that surpasses his debt obligations and, as a result, will be eligible for a DSCR mortgage.

What is the Minimum DSCR Requirement for an Arizona DSCR Loan?

Depending on the lender, the minimum DSCR (debt service coverage ratio) required for Arizona DSCR loans often ranges from 1 to greater. The DSCR ratio is used by lenders to determine if a property can generate enough rental income to meet its mortgage payments.

How Do I Secure a DSCR Loan in Arizona?

Locate a DSCR Lender

To obtain a DSCR loan, you must first locate a lender who provides them.

Requesting a DSCR Loan

After you’ve decided on a DSCR lender, learn about their application procedure and requirements.

Fill up the required documentation and submit your application.

Provide Proof of Property Income

To establish your creditworthiness, you must demonstrate the earning potential of the property you wish to purchase.

Submit the necessary papers demonstrating your property’s ability to generate enough money to cover the mortgage payments.

Calculating DSCR and 1007 Rent Schedule

After you submit your loan application, the lender will review your Debt Service Coverage Ratio (DSCR) to ensure it is greater than one, which is required for mortgage approval.

In addition, the lender will get a 1007 Rent Schedule to establish your property’s fair market rent and confirm its ability to repay mortgage payments.

Closing

You will sign the loan documents and pay the appropriate closing charges at the closing stage of the DSCR loan application procedure.

This is the final stage before the lender releases the funds, and it usually entails completing an array of paperwork and paying for things like property inspections, appraisals, and title searches.

Once the loan has been funded, you can use the funds to buy or refinance investment properties.

By following the steps indicated, obtaining a DSCR loan becomes a simple process, allowing you to begin investing and reaping returns.

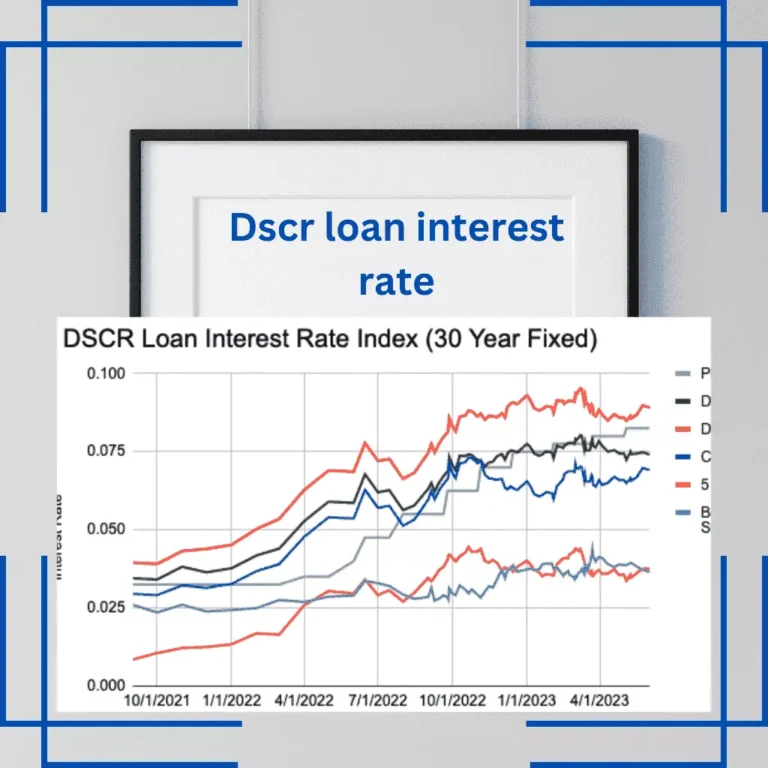

What are the DSCR mortgage interest rates in Arizona?

DSCR mortgage interest rates in Arizona depend on the DSCR lender and the borrower’s requirements. Because of their increased risk, DSCR loans often have higher interest rates than standard mortgages. Rates for DSCRs range from 7.5% to 8.82%; rates may vary from lender to lender or be higher based on criteria such as credit score, down payment, loan size, and property type. Therefore, search around and acquire estimates from lenders to determine the correct rate for your case.

Who Can Get a DSCR Loan in Arizona?

Real Estate Investors

DSCR loans Arizona are suitable for real estate investors who wish to buy many properties to maximize their monthly rental revenue. Borrowers can qualify for these loans based on the rental revenue of the property rather than their own income.

Portfolio Investors

DSCR loans are beneficial for big portfolio investors who wish to finance the purchase of many properties and utilize the rental revenue produced by those properties to pay off the loan.

Self-Employed People

Borrowers who are self-employed and do not have W-2s or pay stubs can qualify for a DSCR loan. These loans are ideal for people looking to invest in a number of properties and create rental income. Bank statement loans may be a good option for self-employed borrowers looking to buy a primary dwelling.

Freelancers

Freelancers or contract employees might utilize this financing to purchase an investment property. The loan is based on the property’s rental revenue rather than their own, making it easier for them to qualify.

Small Entrepreneurs

Small company entrepreneurs are also able to use this lending scheme to purchase an investment property without having to provide personal income verification. These loans can assist them in financing the acquisition of new properties and increasing their monthly rental revenue.

Real Estate Market in Arizona

The Arizona housing market has been seeing a reduction in home prices, with the median price for a home in January 2023 being $406,200, a 3.8% decrease from the same month in 2022. The number of properties sold in the state has also decreased by 39%, while the average number of days residences are on the market has increased. However, market conditions vary across the state, with premium regions like Sedona and Scottsdale witnessing year-over-year growth.

Lowering prices, on the other hand, can be a fantastic chance for investors to purchase a property at a reasonable price and keep the rental revenue because there is no rent decrease.

Furthermore, based on historical data, the market is in a correction, and you should expect excellent property worth appreciation in the next few years.

Top five cities in Arizona for rental property investment

Phoenix

Despite recent property price increases, Phoenix is still considered reasonable for real estate investors. With a population of over 1.7 million people and rapid job development, is a prosperous city that attracts IT and manufacturing firms. Because of its rising population and various attractions, there is a significant demand for accommodation, including rentals.

Tucson

Tucson is a developing but inexpensive market with high rentals and low housing prices. Rental income and property value increase might benefit investors, since values have nearly quadrupled since 2015. Tucson, with its good average daily prices for Airbnbs and high occupancy rates, offers chances for consistent rental revenue and possible development.

Mesa

The state’s third biggest city offers a solid real estate investment opportunity, with two-bedroom apartments renting for over $1,500 per month. With real estate values expected to rise by more than 27% each year, investors may profit from future property value appreciation in this thriving market.

Chandler

Chandler is a dynamic community in Arizona’s East Valley that provides a mix of suburban charm and metropolitan conveniences. Young professionals seeking top-rated institutions and a vibrant social scene flock to the city. Chandler is a good area for real estate investment due to its closeness to Phoenix and plenty of parks.

Scottsdale

Scottsdale is known for its bustling nightlife, gorgeous landscapes, and world-class golf courses. It is located near Phoenix. Scottsdale is an appealing alternative for real estate investors due to its popularity and expected value increase of 30% each year.

Invest in an area where you are aware and competent in order to become an expert and control the industry.

How to Invest in Arizona Real Estate?

Here are some suggestions for real estate investing in Arizona.

Hiring a Property Management Company

By managing activities such as tenant screening, rent collecting, maintenance, and repairs, a property management business may save real estate investors time and money. Furthermore, they may guarantee that rental homes comply with state legislation, reducing the possibility of legal complications.

Long-Term vs. Short-Term Rentals

Real estate investors in Arizona must choose between typical long-term rental assets and short-term rental properties. While long-term rentals give consistent revenue, holiday rentals bring bigger earnings but with greater volatility.

Prioritize Cash Flow

To maintain profitability and success as an Arizona real estate investor, it is critical to prioritize cash flow above potential appreciation. The cash flow created by the rental property can assist pay expenditures and offer a consistent stream of income.

Seek Mentoring

For assistance and learning opportunities, look for mentoring options with a successful investor or join a local real estate investor’s organization.

The Advantages of a DSCR Loan in Arizona

No Need for Personal Income Verification

As lenders do not require proof of income or employment verification, DSCR loans offer a substantial benefit. Instead, they simply assess the property’s cash flow, making it more accessible to borrowers who do not fulfill traditional mortgage standards.

Faster Application and Closing Times

Because they bypass processes like reviewing work history and paystubs, DSCR loans are easier to get than conventional mortgages. Borrowers will benefit from a faster closing time.

Capability to Finance Several Properties Simultaneously

Unlike standard loans, which limit borrowers to one property at a time, DSCR loans allow investors to acquire numerous properties at the same time. This enables investors to rapidly and effectively build their holdings.

Appropriate for Both Novice and Experienced Real Estate Investors

DSCR loans are appropriate for all sorts of real estate investors, whether new or experienced. These loans are an excellent starting point for novice investors and can assist seasoned investors in expanding their real estate holdings. In summary, a DSCR investor loan is an excellent financing choice for all types of real estate transactions.

Conclusion

Investing in Arizona real estate might be a wise approach to diversify your portfolio while also ensuring long-term rewards. Before investing, however, it is critical to understand the local market, legislation, and processes.