How to Get Approved For a DSCR Loan? 7 Essential Tips

If you’re searching for financing to establish or develop your business, you’ve probably heard of DSCR loans. DSCR stands for Debt Service Coverage Ratio, which is a financial indicator used by lenders to estimate your capacity to repay the loan. In simple terms, DSCR measures the amount of cash available to satisfy your debt commitments. There are several important guidelines to follow if you want to get approved for a DSCR loan. In this article, we will go through those ideas and how they may help you get approved for a DSCR loan.

Understanding DSCR Loans

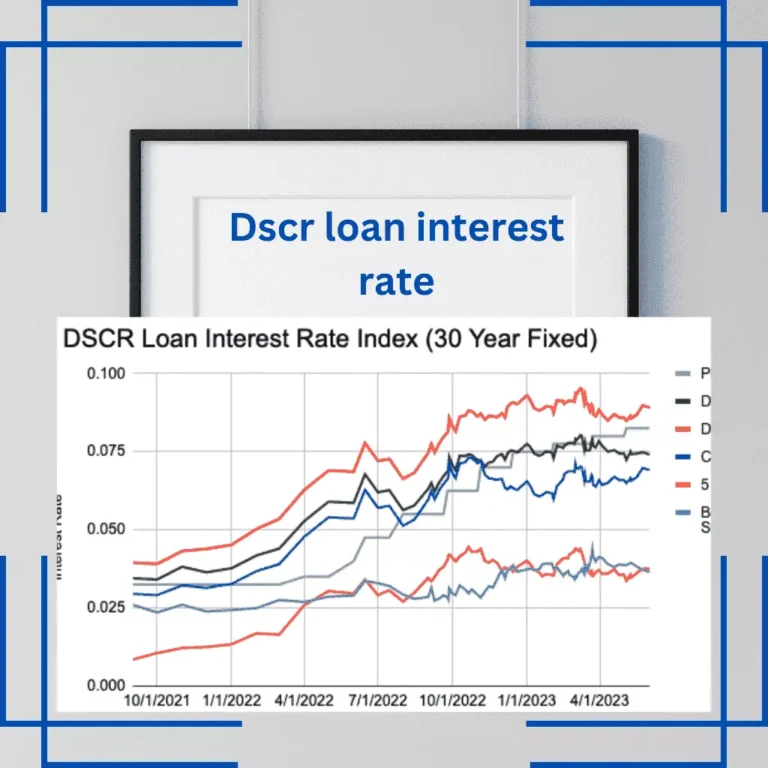

Before we proceed into the tips, let’s first define DSCR loans and how they work. A DSCR loan is a type of commercial loan used to fund commercial real estate such as office buildings, warehouses, and retail spaces. The loan is backed by the property and is usually repaid over a 15-30 year period. Because the property acts as security, the interest rate on a DSCR loan is often lower than that of other forms of company loans.

The Debt Service Coverage Ratio is the most important criteria that lenders assess when accepting a DSCR loan. This ratio is derived by dividing the net operating income (NOI) of your property by the annual debt service (ADS). The greater the ratio, the more likely you are to get accepted for a DSCR loan. To qualify a loan, lenders normally want a DSCR of at least 1.25.

Tips to Get Approved for a DSCR Loan

Improve Your Credit Score

Your credit score is one of the most essential elements that lenders check when granting a DSCR loan. A high credit score demonstrates that you are responsible for your finances and have a track record of paying your payments on time.

If you have a low credit score, you should work on improving it before applying for a DSCR loan. Paying your bills on time, lowering your credit card balances, and contesting any inaccuracies on your credit report can all help you boost your credit score.

Minimize Debt and Maximize Income

Lenders like residences with a low debt to income ratio. Examine your finances before applying for a DSCR loan and search for strategies to boost your income and minimize your debt. This might involve increasing rents, lowering spending, and repaying current debt.

You may boost the property’s DSCR and your chances of loan approval by enhancing revenue and decreasing debt.

Increase Your Net Operating Income

As we know that the Debt Service Coverage Ratio is calculated by dividing the net operating income (NOI) of your property by the annual debt service (ADS). As a result, boosting your NOI can help you be accepted for a DSCR loan.

You may boost your NOI by boosting your rental prices, lowering your operational expenditures, and increasing the occupancy rate of your property.

Prepare a Detailed Business Plan

Before approving you a DSCR loan, lenders want to establish that you have a good business strategy. A full description of your business, your marketing strategy, financial predictions, and management staff should all be included in your business plan.

A well-written business plan helps demonstrate to lenders that you have a clear vision for your company and that you are able to repay the loan.

Prepare Detailed Financials

To secure a DSCR loan, you have to submit precise financials that correctly reflect the revenue and costs of the property. Rent rolls, operational statements, tax filings, and other financial papers are examples of this. The lender will use this information to compute the DSCR and the NOI of the property.

It is critical to keep your finances precise and up to date. If lenders detect deviations or inconsistencies in the financial documentation, they may reject the loan application.

Provide Collateral

Although DSCR loans are secured by the property, you can increase your chances of approval by submitting additional collateral. This might include personal assets like your home or automobile, as well as real estate holdings you own.

Providing collateral demonstrates to lenders that you are ready to risk your own assets to acquire the loan.

Work with a Commercial Mortgage Broker

Working with a business mortgage broker might be beneficial if you are new to the world of commercial real estate finance. A broker can assist you in navigating the loan application process, locating the best loan conditions, and negotiating on your behalf with lenders.

They may also provide you vital advise on how to enhance your chances of getting a DSCR loan approved.

Have a Backup Plan

Getting approved for a DSCR loan can be difficult, and the lender may reject your application in some cases. If this occurs, it is critical to have a backup plan in place.

Other financing alternatives include standard loans, private money lenders, and even equity partnerships. Even if the DSCR loan goes through, having a backup plan in place might offer you the peace of mind to continue with your investing objectives.

Conclusion

Getting approved for a DSCR loan can be a difficult process, but by following some crucial guidelines, you can improve your chances of obtaining the funding you want to expand your business. Improving your credit score, boosting your net operating revenue, developing a clear business plan, providing collateral, and engaging with a commercial mortgage broker are all actions that can help you get a DSCR loan authorized.

Remember that lenders want to see that you have a good financial background as well as a reliable repayment plan. You may demonstrate that you are a responsible borrower and boost your chances of getting approved for a DSCR loan by taking the time to prepare your application and following these guidelines.

FAQs

What is a DSCR loan?

A DSCR loan is a type of business loan that is used to finance commercial real estate properties. The loan is secured by the property and is repaid over a period of 15-30 years.

What is the Debt Service Coverage Ratio?

The Debt Service Coverage Ratio is a financial metric that lenders use to determine your ability to pay back the loan. It measures how much cash flow you have available to pay your debt obligations.

What is a good DSCR ratio?

Lenders typically require a DSCR of at least 1.25 to approve a loan, but a ratio of 1.5 or higher is preferred.

How can I improve my credit score?

You may raise your credit score by paying your bills on time, lowering your credit card balances, and solving any inaccuracies on your credit report.

Do I need collateral to get approved for a DSCR loan?

DSCR loans are secured by the property, but providing additional collateral can improve your chances of getting approved. This could include personal assets, such as your home or car, or other real estate properties that you own.

![DSCR Loan in North Carolina [2023]: Mortgage Possibilities without W2 Requirements](https://loansformula.com/wp-content/uploads/2023/06/DSCR-Loan-in-North-Carolina-768x768.png)