DSCR Loans Georgia (2024): No Income Verification Required Easy Guide

Do you want to make an investment in Georgia real estate? A DSCR loan is a loan for real estate investors that is determined by your rental income from the property you are financing. It is adaptable, with no personal income verification necessary.

Do you want to know how to receive a DSCR loans Georgia?

This article will look into DSCR loans in Georgia, how they function, and why they can be a good option for your next Georgia investment.

What are DSCR Loans?

DSCR loans, also known as Debt Service Coverage Ratio (DSCR) loans, assess an individual’s or business’s capacity to repay debts. The ratio compares rental revenue from an investment property to monthly mortgage payments.

Most DSCR loan lenders demand borrowers to have a DSCR greater than 1.0, indicating that the property has positive cash flow and can service its debt.

Some DSCR lenders may accept the loan with (DSCR1), however you will be required to make a larger down payment.

To assess eligibility, DSCR lenders consider other variables, such as the down payment amount and credit score, in addition to the DSCR ratio.

If you want to learn everything there is to know about DSCR, we have the DSCR loans guide for you.

Why Should You Invest in Georgia Real Estate?

Georgia is an appealing alternative for real estate investors due to its numerous favorable circumstances. The state offers a more business-friendly atmosphere and lower land prices than other East Coast states.

Furthermore, Georgia’s population grows significantly year after year, making it a great site for investors wishing to profit on rental markets or create new homes.

Real Estate Market in Georgia

Georgia’s real estate market provides a wide range of property types for investors to examine. Major cities in the state, like Atlanta and Savannah, provide a wide range of housing alternatives, from suburban single-family houses to multi-story condominiums and apartments.

- The Georgia Realtors Association reports that the state’s real estate market has consistently improved in recent years.

- In 2022, the median sales price increased by 21% over the previous year, reaching $306,113.

- Furthermore, the number of residences sold in the state increased by 9% in April 2022.

- The rental yield in Georgia varies by location, ranging from 2-3%, while the yearly property appreciation rate is 14%.

- Investors could also examine the state’s smaller towns and rural areas, where house costs are more inexpensive.

With excellent financing options and a variety of industrial, commercial, and retail properties available, the state also provides lots of chances for real estate investors.

What is DSCR Loan Georgia?

The DSCR Loan Georgia is a mortgage lending program designed to assist investors in the purchase of real estate. This program, which requires the borrower’s DSCR to be more than one, might offer favorable terms to investors wishing to finance their Georgia investment property.

Lenders in Georgia frequently employ it to evaluate the creditworthiness of potential borrowers, especially when making loans.

If you want to get a DSCR loan in Georgia, you need to consult with a competent lender who can explain the eligibility requirements and walk you through the application process.

DSCR Loan Georgia Requirements

If you live in Georgia and are considering a DSCR loan, there are a few standards you must complete. The term debt service coverage ratio (DSCR) refers to your capacity to repay your debt obligations with your net operating income.

The following are some of the major conditions for a DSCR loan in Georgia:

Sufficient Net Operating Income

You must have enough net income to meet your debt service in order to qualify for a DSCR loan. Typically, a DSCR ratio of at least one is required, indicating that your home generates enough income to cover the mortgage.

A solid credit score

A good credit score is required to qualify for a DSCR loan in Georgia, as it is for other loans. Lenders normally demand a credit score of at least 620, however restrictions vary per lender.

Strong Business Plan

If you are purchasing a commercial property, lenders will want to see a robust business plan detailing how you intend to use the DSCR loan money.

Down payment

Borrowers may be required to pay a down payment of 20-25% of the property’s value in addition to completing the DSCR standards.

If you match these criteria, you may be eligible for a DSCR loan in Georgia. However, it’s always a good idea to shop around and compare rates and terms from other lenders to ensure you receive the best deal.

Why Do Real Estate Investors Use DSCR Loans Georgia?

In Georgia, real estate investors employ DSCR loans to finance their investments, such as rental homes. Investors are more likely to qualify for the investment loan since the loan is based on the property’s revenue rather than the borrower’s personal financial history.

Let us look at some of the reasons why investors in Georgia employ DSCR loans:

- To acquire investment property.

- To improve the terms of an existing investment mortgage.

- The rental revenue from the property covers the mortgage payment on the DSCR loan.

- Expansion or renovation of an existing investment property.

- These loans are based on the property’s ability to generate revenue.

- To begin a new business enterprise that necessitates the acquisition of real estate.

- DSCR loans are more adaptable and simple to get than standard mortgages.

- To consolidate debt and boost their company’s cash flow.

- Interest rates for DSCR loans are often somewhat higher than on standard loans.

Because DSCR loans have longer payback periods, the loan amount may be stretched out over a longer period of time, providing for more flexible cash flow.

Furthermore, DSCR loans are frequently less dependent on personal income than other forms of financing and may require less paperwork, such as tax returns, to be approved.

What is the Debt Service Coverage Ratio (DSCR)?

Borrowers in Georgia must fulfill the Debt Service Coverage Ratio (DSCR) standards in order to qualify for a DSCR loan. But first, let us take a closer look at the DSCR:

DSCR Loan Calculation: In Georgia, calculate DSCR Loans.

Divide your annual net operating income (NOI) by your total debt payments for the year to determine your DSCR. The outcome is the ratio of your NOI to your debt payments, which is known as your Debt Service Coverage Ratio.

For example, if John had a rental property with a NOI of $50,000 and an annual loan payment of $30,000, her DSCR is 1.67 ($50,000/$30,000).

What is the Net Operating Income of DSCR Investor Loans?

Net Operating Income (NOI) is critical in establishing your DSCR ratio. NOI is the amount of money generated by a property after all expenses, such as taxes and running costs, have been deducted.

Based on the rental revenue, monthly expenses, and other costs associated with the property, John’s net operating income might be $50,000.

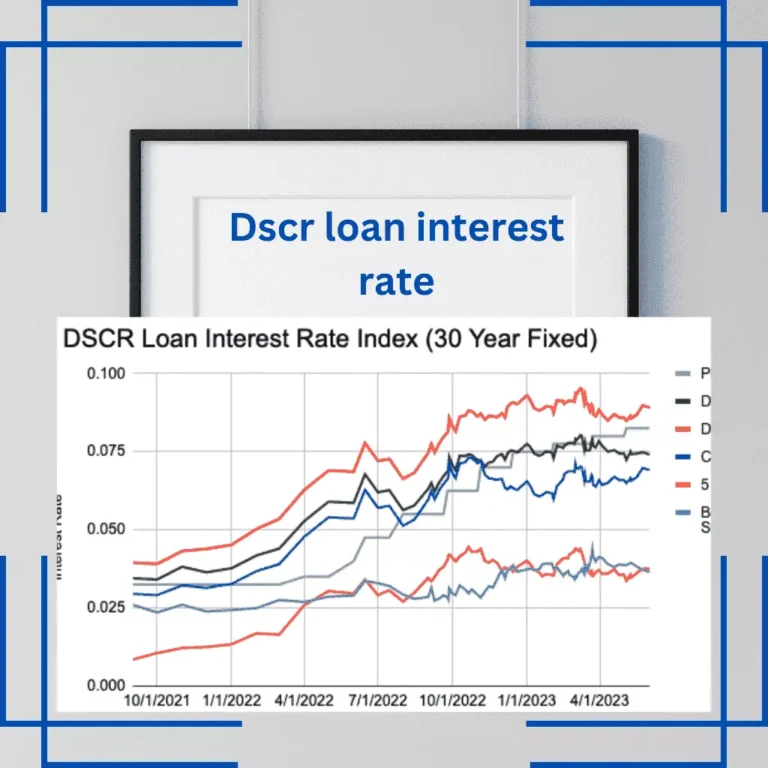

DSCR Loan Georgia Interest Rates

DSCR loan interest rates in Georgia vary based on the lender and the loan parameters. DSCR loans often have interest rates that are 1-2% higher than standard commercial loans. Borrowers with a good credit history, on the other hand, can get better terms.

DSCR lenders often provide higher interest rates than standard lending. Keep up with the latest DSCR loan interest rates by reading our blog, which is often updated so you can always keep informed.

Georgia Factors Influencing DSCR Loans

The DSCR is determined by a number of criteria, including rental income, cash flow, down payment amount, credit score, and so on. This information will be used by lenders to assess if a borrower can afford the loan repayments.

Let’s take a look at each factor one by one:

Interest Rates

Higher interest rates can raise the DSCR since more money is needed to pay off the loan, resulting in a DSCR ratio.

Economic Conditions

Economic conditions can have an effect on a borrower’s cash flow, which can affect the DSCR. A downturn in the economy might reduce cash flow and have a negative influence on the DSCR.

Loan Term

A longer loan term can improve the DSCR by allowing for fewer debt service payments over a longer period of time.

Rental Rates

If rental rates are low or fall, net income and DSCR will fall.

Vacancy Rates

A high vacancy rate reduces rental income, lowering the DSCR.

Property Value

If the property value falls below or falls below the loan amount, the DSCR will suffer.

When qualifying for a DSCR loan Georgia, real estate investors must evaluate all of these variables. She must also verify that her credit score is in good standing and produce all required tax records and other evidence to demonstrate her capacity to repay the loan.

What are the DSCR Loan Program Fees and Costs?

Closing expenses, application fees, prepaid interest, and other fees connected with a DSCR loan Georgia will vary according to the lender. As a result, it is critical to carefully evaluate these costs before entering into any loan deal.

Using DSCR Loans to Invest in Rental Property in Georgia

DSCR loans Georgia are a crucial financial instrument for real estate investors, allowing them to purchase and improve rental properties without relying on their income or credit history.

Lenders can analyze an applicant’s eligibility for a loan based on rental revenue generated by the property using the DSCR as a measure of repayment ability.

Let us learn about the requirements for DSCR loans in Georgia.

How to Get a DSCR Loan in Georgia

If you want to qualify for a debt service coverage ratio (DSCR) loan, you need to consider a few essential elements.

Here are some tips for increasing your chances of getting approved for a DSCR loan Georgia

Calculate your DSCR

The first stage is to compute your debt service coverage ratio (DSCR), which assesses your capacity to service your debt. Divide your net operating income (NOI) by your annual debt payments to get your DSCR.

Maintain a normal DSCR.

To qualify a loan, lenders normally want a DSCR of 1 or above. If your DSCR is lower than this, you may need to boost your NOI or cut your loan payments to raise it.

That is, the property’s DSCR must be at least a minimum of 1 or greater.

Show Solid Financials

Lenders will also look for evidence of strong financials, such as a good credit score, positive cash flow, and a history of paying your obligations on time. So, here are some things that may affect your ability to obtain a DSCR loan in Georgia:

- A minimum credit score of 620

- A down payment of at least 20-25%

- The property must fulfill the lender’s specifications.

LTV (Loan to Value) Ratio

The LTV ratio compares the loan amount to the value of the underlying property. Lenders want a loan-to-value ratio of 80% or less.

Work With a Professional Lender

Finally, engaging with an experienced DSCR loan lender will help you be approved. Look for a lender with DSCR loan expertise, and be prepared to answer questions about your company and finances.

Applicants who satisfy these requirements can obtain a DSCR loan Georgia and use it to acquire rental homes or finance other investment projects.

How to Figure Out Your Monthly Mortgage Payments

You must calculate your monthly mortgage payments once you have been accepted for a DSCR loan Georgia. To do so, you must first determine the loan amount, interest rate, and term duration. Then, you may estimate your monthly payments using an online calculator or a typical amortization method.

You may improve your chances of loan approval by understanding the requirements for DSCR loans Georgia, evaluating your debt service coverage ratio, and arranging your finances properly.

You may begin investing in rental homes today if you have access to the appropriate funds and guidance.

What Is Positive Cash Flow for Investment Property and How it Can Help?

Positive cash flow is the money that remains after all essential costs have been met. Loan payments, taxes, insurance, maintenance, and other relevant fees are all included. Having a healthy cash flow from your rental property means you’ll have extra money in your pocket each month.

For example, suppose you had a $100,000 loan on an investment property with $536.57 monthly payments. If the rental revenue is $1,500 per month, you have a positive cash flow of $963.43 per month ($1,500 – $536.57).

When lenders evaluate your loan qualifying, positive cash flow is a critical element. As a result, selecting the suitable property with the ability to generate adequate rental income might improve your chances of being accepted for a DSCR loan in Georgia.

A DSCR Loan Georgia can provide you with the funds and financial assistance you need to invest in rental or other investment properties.

Locating DSCR Loan Georgia Lenders

Finding DSCR loans in Georgia might be a daunting task. With so many different lenders providing various sorts of loans, determining which ones are suitable for your situation might take some effort.

Fortunately, with the assistance of an expert DSCR lender, you can guarantee that you obtain the finest loan terms available while still fulfilling your financial objectives.

Let’s go through some ideas for finding the best DSCR lender for you so that you may be connected with the best DSCR lender or obtain quotations from numerous lenders to compare and pick.

How to Find the Best DSCR Loan in Georgia

When looking for a good Debt Service Coverage Ratio (DSCR) financing program in Georgia, keep the following points in mind:

Investigate various lenders

It is critical to investigate the reputations of other Georgia lenders. Look for lenders who provide loans with suitable conditions and rates.

Examine your financial status

You must first examine your financial status before applying for a DSCR loan. To assess your loan eligibility, lenders will look at your credit score as well as the cash flow of the property.

Examine various lending schemes

Take the time to evaluate the many investment loan plans available from lenders. Seek for packages with flexible payback terms and cheap interest rates.

Seek expert assistance

Consult with DSCR loan experts such as financial counselors or accountants. They can assist you in determining which loan program is suitable for your financial condition.You can get the proper loan that matches your financial needs and goals if you keep these guidelines in mind when looking for a DSCR loan program in Georgia.

Make the most of your Georgia real estate investment by seeking assistance from professional mortgage lenders with extensive market expertise.

The Advantages of DSCR Loans Georgia

Here are some of the advantages of DSCR loans in Georgia:

Enhanced Cash Flow

The property’s revenue, not the borrower’s, is the major source of repayment for DSCR loans. The borrower may be able to boost their overall cash flow by investing in new properties.

Personal Credit History is Less Important

Because the property’s revenue secures DSCR loans, borrowers with low personal credit histories may be more likely to qualify for this form of loan.

Loan Amounts That Are More Significant

Because lenders primarily consider the revenue of the property to evaluate repayment capabilities, borrowers may be able to acquire larger loan amounts with a DSCR loan than with a standard commercial loan.

Longer Loan Terms Are Available

DSCR loans sometimes have longer payback terms than standard commercial loans, giving borrowers a longer length of time to earn revenue from the property.

Overall, DSCR loan Georgia provides various advantages to real estate investors who lack the necessary paperwork and credit history to qualify for a conventional loan.

Conclusion

A DSCR loan Georgia might make it easier to purchase a rental or other investment property. Instead of your own income and credit history, the anticipated revenue from your property is the primary qualifying consideration.

All you need is the proper DSCR lender to guide you through the procedure and provide you with attractive loan terms to fund your investment.