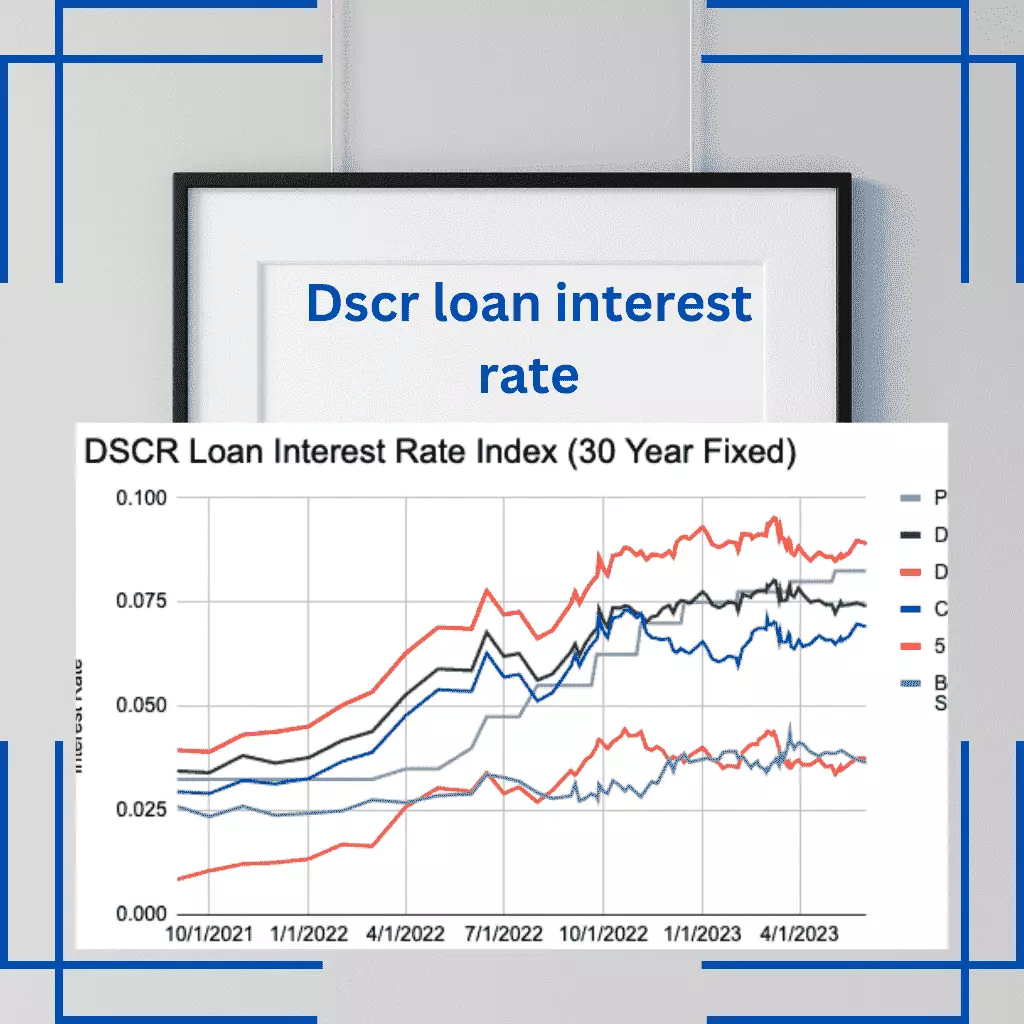

Latest DSCR Loan Interest Rates (2024)

The DSCR Loan has grown as a popular loan option among real estate investors in the United States. Its simple, quick, and simple acquisition makes it an appealing lending alternative for those looking to acquire a loan based on the income of their property rather than their own income. However, before applying for a DSCR loan, it is necessary to understand the associated DSCR loan interest rates, different types of interest rates, and the factors that influence interest rates. Remember that interest rates have a long-term impact on borrowers’ capacity to make monthly payments and loan budgets. If you are thinking about getting a DSCR loan, you should know the latest DSCR loan interest rates.

What is the current DSCR loan interest rates for 2024?

Today’s DSCR Interest Rates: 7.43%-8.43%

Current DSCR loan interest rates range from 7.43% to 8.43%; rates may differ depending on the lender, your DSCR, and other factors. In general, DSCR loan rates are 1-2% higher than standard mortgage rates. This varies from loan to lender, so you should seek quotations from several lenders and choose the best one for you.

How Do I Calculate the DSCR Loan Interest Rates?

DSCR loans, also known as debt service coverage ratio loans, are distinct from other types of loans. The interest rate on DSCR loans is not affected by the borrower’s personal credit score or history. Instead, the positive cash flow of the gross rental revenue, net operating income, DSCR mortgage, and debt obligation influences the loan’s interest rate. The DSCR is a mathematical computation that divides the net operating income of a real estate investment by the total debt service.

A high DSCR score indicates that the purchasing property can easily meet its needed annual loan payments, whereas a low DSCR value shows that the subject property may struggle to earn enough revenue to satisfy the debt obligations.

This figure is critical in determining the property’s ability to generate monthly rental income or positive cash flow in order to fulfill its debt commitments. As a result, the lender use the DSCR to determine the stability of the real estate property and the level of risk involved with accepting a maximum loan amount for that specific property.

The greater the DSCR ratio, the lower the interest rate because there is less financial risk. A low DSCR, on the other hand, will result in a higher interest rate because it indicates a larger chance of default on the loan terms.

Types of DSCR Loan Interest Rates

Based on the interest rates, DSCR loans are widely categorized into two types:

1. Interest Rates That Are Fixed

Fixed interest rates, as the name implies, remain unchanged throughout the loan duration. The borrower is not exposed to the danger of unexpected interest rate increases, which could result in an increase in monthly loan payments.

Monthly payments stay unchanged as well, making it easy for borrowers to budget their expenses. This rate is excellent for people who do not want interest rate fluctuations.

2. Variable Interest Rates

Adjustable interest rates alter in response to market conditions. These rates are evaluated and altered on a regular basis, usually once a year.

Any change in the adjustable interest rate will result in a change in the monthly installments. The monthly payments are also affected by changes in interest rates. This rate is ideal for people who are willing to accept the risk of fluctuating interest rates.

Factors Affecting DSCR Loan Interest Rates

The DSCR loan interest rates are affected by a number of things. Considering these variables while applying for a loan might help prospective borrowers stay more informed and prepared for the DSCR program.

Amount of the Loan

The loan amount is critical in setting the interest rate for DSCR loans. A larger loan amount means a greater interest rate.

Type of Property

The type of property also has an impact on the interest rate. A business property, for example, will have a higher interest rate than a residential home since lending to a commercial property involves a bigger risk.

Loan Term

Another major component influencing DSCR loan interest rates is loan term. A longer loan term means that the borrower is more likely to default. Borrowers that want a longer loan tenure pay a higher interest rate.

Collateral

Another major component influencing the interest rate on a DSCR loan is the collateral. Because collateral reduces the risk of default, lenders provide lower interest rates to borrowers who provide collateral.

Location

The location of the property also influences the interest rate on a DSCR loan. Lenders regard properties in high-risk zones or in areas prone to disasters to be a higher risk. Borrowers seeking a loan for such homes face higher interest rates from lenders.

The criteria listed above are some of the most critical ones that influence the interest rate on a DSCR loan. Before taking out a DSCR loan, borrowers should carefully analyze all of these considerations.

How Can I Get a Lower DSCR Loan Interest Rates?

There are ways to obtain a lower DSCR loan interest rate, allowing for adequate monthly cash flow from the rental property.

Get a Good Deal

If the property has a higher DSCR ratio, DSCR lenders provide reduced interest rates on DSCR loans. For example, an investment property with a DSCR of 1.50 that generates 50% more rental income than payment has a lower interest rate than a property with a DSCR ratio of 1.1.

Payment in Advance

A large down payment indicates that the DSCR lender is less risky, arguing for reduced interest rates.

Profit from Experience

When pricing DSCR loans, DSCR lenders consider your experience as a real estate investor. As a result, you can be optimistic about capitalizing on your experience while applying for DSCR loans.

Conclusion

DSCR loan interest rate is determined by various factors, including loan tenure, collateral, geography, and current market conditions. Borrowers should verify the most recent interest rates before applying for a DSCR loan.