DSCR Loan VS Conventional Loan | Which is Right For You?

As a real estate investor, getting financing can be tough, especially if you’re new to the game. Traditional forms of financing, like conventional loans for first-time buyers, may not work for your investment. But don’t worry, there are alternative financing options available, like the debt service coverage ratio (DSCR) loan.

Unlike conventional loans, DSCR loans look at your DSCR ratio instead of just your income when considering your application. This means you can qualify based on the projected income of the property you’re investing in, which makes it a popular choice among real estate investors.

But what exactly is the difference between a DSCR loan and a conventional loan? Which one is the right choice for your investment needs? In this article, we’ll explore the strengths and weaknesses of both loan types so you can make an informed decision. So, whether you’re a seasoned investor or just starting out, read on to discover which loan is the best fit for you – DSCR Loan vs Conventional Loan.

What is a DSCR Loan?

If you’re looking for financing for a rental property, a DSCR loan could be an option for you. These loans differ from conventional fixed-rate mortgage loans because they are approved based on the income from the rental property rather than income requirements. This means that the guidance and requirements for DSCR loans are often more flexible.

What is a Debt Service Coverage Ratio?

The Debt Service Coverage Ratio (DSCR) is a calculation used to evaluate the likelihood of a borrower repaying their loan by comparing their debt to their gross rental income. This calculation is crucial for determining the feasibility of investing in a rental property.

How to Calculate DSCR Loan?

To calculate the DSCR, you need to know the gross rental income and the total debt service or total monthly mortgage-related expenses. Divide the gross rental income by the total debt service, and you’ll have your DSCR. A DSCR of 1 means that the rental income only covers the costs of maintaining the property, while a DSCR of 1.25 or higher offers more financial cushion.

Is a DSCR Loan Conventional?

No, a DSCR loan is not a conventional home loan. It’s a specialty mortgage that falls under the umbrella of Non-QM loans, which offer alternative financing methods. This means that borrowers can secure financing without going through typical income verification methods.

DSCR Loan Requirements

While DSCR loans offer a more flexible path to rental property ownership, there are still some requirements. For example, borrowers need to have a minimum credit score of 620 and a minimum DSCR of 0.75. Additionally, borrowers may need to have 12 months of cash reserves for DSCR ratios less than 1.

DSCR Loan vs Conventional Loan – Which is Right for You?

When comparing DSCR loans to conventional loans, it’s essential to consider your unique financial situation and investment goals. Some factors to consider include your credit score, debt-to-income ratio, and the type of property you’re investing in. While DSCR loans offer more flexibility, conventional loans may be a better fit for certain borrowers. Contact a lending professional to help determine which loan is right for you.

Key Takeaways

- DSCR loans are approved based on the income from a rental property rather than income requirements.

- The Debt Service Coverage Ratio (DSCR) is used to evaluate a borrower’s ability to repay a loan.

- DSCR loans are not conventional home loans and fall under the Non-QM umbrella.

- DSCR loans have specific requirements, such as a minimum credit score of 620 and a minimum DSCR of 0.75.

- When deciding between DSCR loans and conventional loans, consider your unique financial situation and investment goals.

Benefits of a DSCR Loan

If you’re an individual real estate investor or investment company, a DSCR loan could be a great option for you. Here are some of the benefits of using a DSCR loan compared to a conventional loan.

Quick and hassle-free approvals

Unlike conventional loans, DSCR loans don’t require income verification or job history. This means you won’t have to worry about providing W-2s, pay stubs, or tax returns for approval, making the application process quicker and easier.

Access to larger loan amounts

With DSCR loans, you can access loan amounts up to $5 million. This means you can invest in larger and more profitable properties that you might not have been able to afford with a conventional loan.

Unlimited cash out

DSCR loans offer unlimited cash out options, allowing you to take out as much equity as you need to fund other investments or expenses.

Interest-only options

DSCR loans also offer interest-only options, which means you can reduce your monthly payments and increase your cash flow.

Short- and long-term rentals

DSCR loans can be used for both short- and long-term rentals, giving you the flexibility to invest in different types of properties.

Close loans in the name of your LLC

If you have an LLC, you can close DSCR loans in the name of your business, providing an added layer of protection for your personal finances.

No limit on the number of properties

One of the most significant advantages of DSCR loans is that there’s no limit on the number of properties you can finance. This means you can expand your portfolio and grow your investments without worrying about hitting a financing limit.

The Drawbacks of DSCR Loan

If you’re an investor looking for a loan to finance a non-owner-occupied property, you may have heard of a DSCR loan. While it can be a viable option for some borrowers, it’s important to be aware of its potential drawbacks, especially when compared to conventional loans.

Higher Down Payment Requirements

One key difference between DSCR loans and conventional loans is the minimum down payment required. Since DSCR loans are designed for riskier lending scenarios, lenders typically require borrowers to put more money down. While conventional loans may allow down payments as low as 3% or 5%, DSCR loans may require 20% or more. This can make it harder for some borrowers to qualify or to afford the upfront costs.

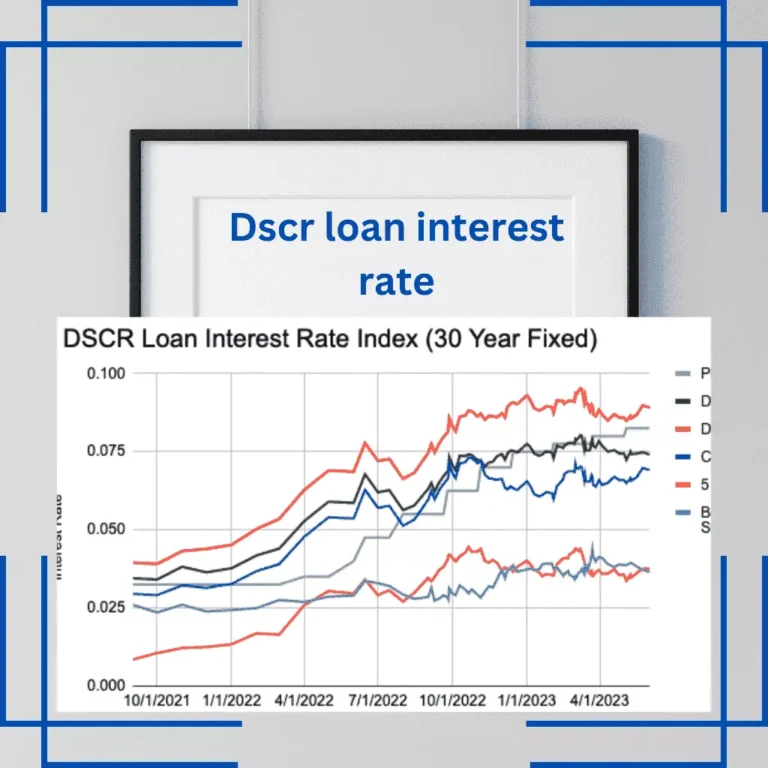

Higher Interest Rates and Fees

In addition to higher down payments, DSCR loans may also come with higher interest rates and fees. Since these loans carry more risk for lenders, they may charge borrowers more to compensate for that risk. This can make a significant difference in the overall cost of the loan, especially over the long term.

More Closing Costs

Finally, borrowers should be prepared for more closing costs when taking out a DSCR loan. These costs can include loan origination fees, appraisal fees, title insurance, and more. While some of these costs may be negotiable, borrowers should expect to pay more than they would for a conventional loan.

What is a Conventional Loan?

When it comes to purchasing a home, most people rely on conventional home loans. These loans come with a range of terms, typically lasting anywhere from 10 to 30 years. Borrowers can choose between a fixed or adjustable mortgage depending on their preference for a stable or fluctuating interest rate.

To qualify for a conventional home loan, borrowers must meet certain criteria set by the lender. This includes providing relevant tax documents to prove consistent income and job history to demonstrate employment. However, it can be challenging to qualify for a conventional loan if you have a non-traditional job or income stream.

The Advantages of Conventional Loans Over DSCR Loans

When it comes to obtaining a mortgage loan, you may have heard of two different options – DSCR loans and conventional loans. While both have their advantages, conventional loans can be the better choice for some borrowers. Here’s why

Lower Down Payment Options

One of the most significant benefits of a conventional loan is the lower down payment requirement. While DSCR loans typically require a higher down payment, conventional loans offer a range of options, including as little as 3% down for qualified borrowers. This can make it easier for first-time homebuyers or those without substantial savings to qualify for a mortgage.

Competitive Interest Rates

Conventional loans also tend to offer more competitive interest rates compared to DSCR loans. This is because conventional loans are widely available and backed by government-sponsored enterprises such as Fannie Mae and Freddie Mac. This increased competition often leads to lower interest rates, which can save borrowers thousands of dollars over the life of their loan.

More Lender Options

The conventional loan market is significantly larger than the DSCR loan market, which means borrowers have access to a greater number of lenders and loan types. This increased competition among lenders can lead to more favorable loan terms, including lower interest rates and more flexible payment options.

The Drawbacks of Conventional Loans

Conventional loans come with a few drawbacks that can make the process of securing financing a bit more challenging.

Long Wait Times and Restrictions

One of the biggest drawbacks of conventional loans is the extensive regulations that come with them. Qualifying for a conventional loan can be an arduous task, and it may take a long time to receive funding. Additionally, there are often restrictions on how you can use the property you’re purchasing, which can limit your investment opportunities.

Frustrations for Real Estate Investors

For real estate investors in a hurry, conventional financing may prove frustrating. The lengthy qualification process, coupled with restrictions on property use, can be a significant obstacle. As a result, many investors are turning to DSCR loans as an alternative option.

DSCR Loans vs Conventional Loans: What’s the Difference?

When comparing DSCR loans and conventional loans, there are some notable differences to consider. DSCR loans are typically used for commercial properties, whereas conventional loans are geared towards individual borrowers purchasing a home.

Additionally, while conventional loans prioritize credit score and income, DSCR loans prioritize the property’s cash flow. In order to qualify for a DSCR loan, the property’s debt service coverage ratio (DSCR) must be high enough to cover the mortgage payments. This means that borrowers may be able to secure a DSCR loan even with a lower credit score or non-traditional income stream.

Key Differences at a Glance

- Conventional loans are for individual borrowers purchasing a home, while DSCR loans are for commercial properties.

- Conventional loans prioritize credit score and income, while DSCR loans prioritize the property’s cash flow.

- DSCR loans may be more accessible for borrowers with non-traditional income streams or lower credit scores.

DSCR Loan vs Conventional Loan: Which Loan is Right for You?

Ultimately, the decision to choose a DSCR or conventional loan depends on your specific circumstances and goals. If you are an individual looking to purchase a home, a conventional loan may be the best option. However, if you are investing in a commercial property, a DSCR loan may be a more viable choice.

Regardless of which loan you choose, it’s important to carefully consider all factors and work with a trusted lender to make an informed decision.

![DSCR Loan in North Carolina [2023]: Mortgage Possibilities without W2 Requirements](https://loansformula.com/wp-content/uploads/2023/06/DSCR-Loan-in-North-Carolina-768x768.png)