Debt Service Coverage Ratio (DSCR Loan) in 2024: A Simple And Comprehensive Guide

Debt-Service Coverage Ratio (DSCR Loan) loan can provide for businesses looking to invest in multifamily and commercial real estate. This type of loan is specifically designed to help businesses finance their real estate purchases, and it can be a game-changer for those looking to expand their operations.

A Debt-Service Coverage Ratio (DSCR loan) is a great option for businesses looking to finance the purchase of multifamily and commercial real estate. DSCR loans offer a unique opportunity for businesses to secure financing based on their monthly cash flow compared to their debt service payments.

DSCR is a valuable tool used by lenders to assess the potential of a property to generate sufficient income to cover the monthly debt payments. This provides opportunities for businesses to secure financing even if they have a less-than-perfect credit rating or insufficient collateral.

Great news! If you’re planning to apply for commercial real estate financing, DSCR loans are definitely worth considering. Here’s what you should know about DSCR loans:

What is a DSCR Loan?

The Debt Service Coverage Ratio (DSCR) is a financial metric used to determine a company’s ability to cover its debt obligations. It may seem complex, but understanding and improving your DSCR can lead to financial stability and growth.

To fully appreciate their value, it’s essential to understand the importance of DSCR and its role in the lending process.

Your debt service coverage ratio is a great tool to ensure that you have enough cash available to service your debt.

This metric helps you understand the amount of cash you have at your disposal to cover both the principal and interest payments for your loan.

This ratio is a useful tool for evaluating the financial feasibility of a property investment. By comparing the property’s net operating income (NOI) with the mortgage debt service on an annualized basis, investors can make informed decisions about the potential profitability of the investment.

Your DSCR is important because it provides lenders with valuable information about your ability to generate sufficient cash flow to pay off your debt. A high DSCR gives the lender confidence that you will be able to make your loan payments without defaulting.

How To Calculate Your Debt Service Coverage Ratio (DSCR)

You can easily determine your DSCR by dividing the net operating income (NOI) of your property by the debt service of the loan (assessed on an annual basis). This will help you assess your financial situation and plan for a brighter future.

You can easily determine your net operating income by subtracting your property’s reasonably necessary operating expenses from the revenue it generates.

You can easily calculate your DSCR by using a simple mathematical formula: DSCR = NOI ÷ DEBT SERVICE.

Understanding How To Calculate DSCR Loans With an Example

Calculating DSCR is a straightforward process that can be easily mastered with practice. With a little bit of effort, anyone can become proficient in this skill and use it to make informed financial decisions.

Imagine you’re a skilled developer who’s ready to take the next step in your life by applying for a mortgage loan from your local bank.

Your bank lender will calculate your DSCR to ensure that you can borrow and pay off your loan while your rental property generates income.

Great news! You confidently inform the bank lender that your NOI is projected to be $2,000,000 per year. Great news! Your lender has informed you that your debt service requirement will be $300,000 per year.

Your DSCR is expected to be 6.67x based on those numbers.

This means that your operating income is more than enough to cover your debt service six times over.

DSCR = 2,000,000 ÷ 300,000 =6.667

Importance of Debt Service Coverage Ratio (DSCR)

DSCR is important because it helps to determine the ability of a company to meet its debt obligations.

Your Debt Service Coverage Ratio (DSCR) provides lenders with valuable information that can help them make informed decisions about the loans they make.

The DSCR is a helpful tool that lenders use to assess a borrower’s ability to pay their debts for a commercial or multifamily property.

Having a higher DSCR can increase your bargaining power with your lender.

What is a Good DSCR Loan?

A “good” DSCR is a positive indicator of financial stability.

Business lenders typically look for borrowers with a DSCR ratio higher than 1.00, which means there are many opportunities for businesses to meet this requirement and secure funding. Great news! Most lenders usually have a minimum of around 1.25.

A DSCR ratio of 1.00 indicates that the property’s cash flow will be sufficient to cover the borrower’s loan payments.

A DSCR ratio of 1.25 indicates that the borrower will have enough funds to comfortably service their loan.

How Debt Service Coverage Ratio (DSCR) Loans Work?

DSCR loans offer financing options for a variety of property types.

- Multifamily properties offer great potential for investment and can provide a steady stream of income.

- Commercial office spaces offer great opportunities for businesses to grow and thrive.

- Hotels and resorts offer many possibilities for relaxation and enjoyment.

- Private mortgages can be a great option for those who may not qualify for traditional bank loans.

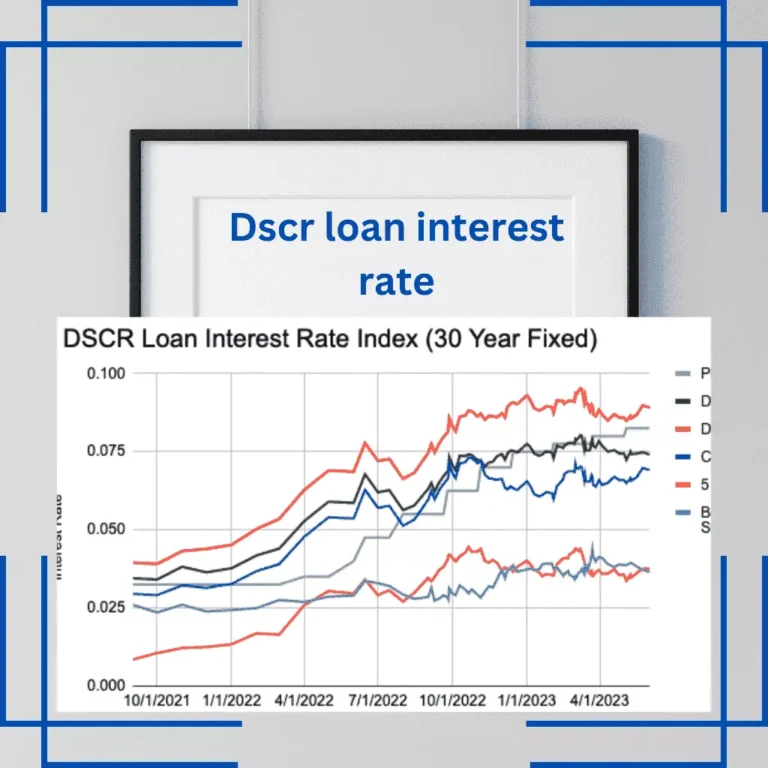

Lenders are flexible with the minimum DSCR number and will adjust it based on the current macroeconomic conditions. In a growing economy, there is a good chance that lenders will be more open to offering DSCR loans, even if the DSCR number is lower.

Many lenders offer DSCR loans for specific types of property to ensure that borrowers are not exposed to risky property types.

The lender will determine the amount of money you can receive through a DSCR loan. Many lenders offer loans with generous limits of up to 3-5 million dollars!

Applying for a DSCR loan is a straightforward process that can lead to financial assistance for your business. With the right information and preparation, you can confidently navigate the application process and potentially secure the funding you need to achieve your goals.

1. Underwriting

Underwriting is an essential process that helps ensure that the insurance company can provide you with the coverage you need.

You can look forward to your lender providing you with a comprehensive outline of the loan, which will cover all aspects such as the loan’s value, terms, fees, and more. Your lender will calculate your DSCR during this stage, which is a positive step towards securing your loan.

2. Documentation

It’s always helpful to have clear and concise documentation to refer to.

You’ll just need to fill out the standard loan documentation for DSCR loans.

When applying for a DSCR loan, you’ll only need to provide financial information related to your business or rental property. You won’t have to disclose any personal income history.

Lenders are willing to offer DSCR loans based solely on your Debt Service Coverage Ratio, which means your personal financial history won’t be a factor.

3. Submission and finalization!

DSCR loans have a faster application and closing process compared to other types of loans since they do not require personal financial history.

The Pros and Cons of Debt Service Coverage Ratio (DSCR) Loans

DSCR loans, like any other type of finance, have their own set of pros and cons.

Pros of Taking DSCR Loans

1. Lenders don’t take personal income into account when making DSCR loans.

DSCR loans do not require your personal financial information. Thus, they are easily accessible to borrowers who may not have a lot of liquid resources.

2. Quick Application Procedure.

Because you won’t need to submit any personal financial information or explain gaps in your job history, DSCR loans often have a streamlined, quick application procedure.

3. You can commit to many properties at the same time.

Some loans require you to commit to only one property at a time. You can’t get a loan for a second property unless you’ve paid off your previous one. But in DSCR loans you can obtain many loans for different properties at the same time.

The Cons of DSCR Loans

1. Terms

Down payments for DSCR loans typically range from 20-25% of the entire loan value. You must pay lender and service costs, which can range from 0.5% to 1% of the total loan amount.

2. Limited financial resources

DSCR rates and conditions may be comparable to other loans, however, they frequently give less overall financing. If your commercial loan requires more than $5,000,000, DSCR loans may not be the best answer.

Conclusion

Finally debt service coverage ratio (DSCR) loans are a great option if you have a revenue-generating business or property. Because they don’t deal with your personal income, they’re an accessible option for property investment.

![DSCR Loan in North Carolina [2023]: Mortgage Possibilities without W2 Requirements](https://loansformula.com/wp-content/uploads/2023/06/DSCR-Loan-in-North-Carolina-768x768.png)