A Comprehensive Guide For Canadian investor in The US Real Estate

Are you a Canadian investor interested in exploring opportunities in the US real estate market? Look no further! Investing in the United States offers an incredible chance to diversify your portfolio and achieve higher returns. The US market boasts a robust economy, a solid legal system, and a wide array of investment options, making it an attractive destination for Canadian investor like yourself.

In this comprehensive guide, we will delve into the essential factors you need to consider when it comes to Canadians investing in the US real estate market. By the time you finish reading this guide, you’ll gain valuable insights and knowledge to navigate the US market successfully as a Canadian investor. Let’s get started!

Why Should Canadians Invest in the US Real Estate Market?

Investing in US real estate offers numerous compelling reasons for Canadian investors. Let’s explore the key benefits:

Diversification

Investing in US real estate provides Canadians with the opportunity to diversify their investment portfolio across different markets and asset classes. By spreading their investments, Canadians can mitigate potential risks arising from market volatility, a notable advantage of real estate diversification.

Building Equity

Real estate investment holds the power of equity. As property values naturally appreciate over time, Canadian investors can build equity by paying off the mortgage and allowing the property’s value to increase. Equity represents a significant asset within one’s net worth, making it an effective means of generating wealth. Notably, homeowner equity has tripled between 2011 and 2022.

Real Estate Appreciation

The US real estate market tends to be larger and more dynamic than its Canadian counterpart, offering higher potential returns in the long run. The market is expected to experience steady growth due to factors such as population growth and the increasing desire for personal household space. Commercial real estate and investment properties have been key drivers of industry expansion.

Stability in Investment

Real estate investment is renowned for its relative stability and consistent value appreciation, even in the face of market fluctuations. Unlike highly volatile options like the stock market, real estate investments are less susceptible to frequent changes or inflation. Real estate properties do not immediately fluctuate in price based on political sentiments or capital contributions. Consequently, real estate is considered a stable and secure long-term investment.

Rental Income

Investing in US real estate can provide Canadian investors with a reliable source of rental income. Rental properties have demonstrated strong performance, with national median rent witnessing a 15.57 percent year-over-year increase in January 2022. This growth added nearly $230 to median rent levels, reaching $1,870. In January 2023, there was a further 2.37 percent yearly rise, contributing an additional $72 to the median rent. Over a two-year period, rents increased by $302 monthly, amounting to an 18.41 percent surge.

Tax Benefits

The US tax code, administered by the Internal Revenue Service (IRS), offers several advantages for Canadian buyers. Income earned from US real estate property by international buyers is subject to a 30% tax rate if it is not effectively connected with a US trade or business.

The US tax system provides tax deductions for mortgage interest and property taxes, along with the option to elect Internal Revenue Code section 871(d) for treating all income from US real property as effectively connected income with a business or trade in the United States. Although Canada also offers some tax benefits, they generally do not match the favorable opportunities available in the US.

Investing in the US real estate market opens up a world of opportunities for Canadians, ranging from diversification and equity building to real estate appreciation, stability, rental income, and advantageous tax benefits. By considering these factors, Canadian investors can make informed decisions to maximize their potential returns in the US real estate market.

How Much Real Estate Do Canadians Purchase Annually in The US?

Based on the NAR’s 2021 Profile of International Transactions in US Residential Real Estate, Canadians constituted 6% of all foreign buyers of US residential property between April 2020 and March 2021. In terms of the overall dollar value of foreign home purchases, Canadians represented 5% of the total, investing an estimated $8.9 billion in US residential real estate during that time frame.

What is the Canada-US Real Property Tax Act?

The Canada-US Tax Treaty serves as a bilateral agreement between Canada and the United States. Its primary purpose is to prevent the issue of double taxation, ensuring that residents of both countries don’t face taxation on the same income.

This treaty is strategically designed to foster cross-border trade and investment, empowering taxpayers to seek credits or exemptions for taxes paid in the other country. Essentially, residents of one country who generate income from sources in the other country are usually taxed solely in their country of residence, with a few exceptions.

For instance, let’s consider Canadian residents working in the United States. While they might be subject to US tax on their income, they can typically claim a foreign tax credit on their Canadian tax return to account for the taxes paid in the US.

The Canada-US Tax Treaty acts as a crucial mechanism to facilitate seamless taxation and encourage economic collaboration between both nations.

Cross-Border Tax Implications for Canadian Real Estate Investors in the United States

As a Canadian investing in US real estate, you should be aware of many cross-border tax issues. Here are a few major considerations:

Income taxation

You will be subject to US federal and state tax on any rental income derived from the US property as a Canadian resident. This rental income may potentially be liable to Canadian income tax. You can claim a foreign tax credit on your Canadian tax return for any US taxes paid to prevent double taxation.

Capital gains taxation

If you profitably sell the US property, you will be liable to US federal and state capital gains tax. You will be liable to Canadian capital gains tax on the same sale as a Canadian resident.

You may, however, be qualified for a capital gains tax exemption under the Canada-United States Tax Treaty, which enables Canadians to exclude up to $250,000 USD in capital gains on the sale of US real estate provided the property was used as a principal residence for at least two years.

The Estate Tax

If you die while owning US real estate, your estate may be liable to US estate tax. The non-resident estate tax threshold in the United States is now $60,000 USD. The Canada-US Tax Treaty, on the other hand, offers a credit for Canadian residents to offset their US estate tax burden.

Reporting of Foreign Investment

You may be required to record your US investment property on your Canadian tax return as well as complete additional foreign investment reporting forms, such as the T1135 form, as a Canadian resident.

You can claim a foreign tax credit on your Canadian tax return for any US taxes paid on rental income to prevent double taxation. This foreign tax credit will assist you in reducing your Canadian tax due by the amount of US tax paid on rental revenue. To correctly report your income and claim any relevant foreign tax credits as a Canadian investing in US real estate, you must keep accurate records of your rental income and costs, as well as any taxes paid.

Understanding Inheritance Taxation and Estate Planning Taxation

If you’re a Canadian with assets in the United States, it’s essential to grasp the concept of US taxation on those assets. Two significant aspects to consider are income tax and estate tax.

Estate Tax

When you pass away, any assets you own in the US may be subject to US estate tax. This tax applies to the transfer of property upon death and is calculated based on the fair market value of the assets at that time. As of 2021, the current US estate tax exemption stands at $11.7 million per individual. This means that if the total value of your US assets is below $11.7 million, you won’t owe any US estate tax. However, if your US assets surpass this amount, you may owe US estate tax on the excess.

Estate Planning

Proper estate planning is crucial to minimize tax liabilities and ensure the distribution of your assets aligns with your wishes. Strategies like creating a will, establishing trusts, and utilizing other estate planning tools are valuable. Seeking guidance from a qualified attorney specializing in US estate planning is recommended to create an effective estate plan that meets your specific needs.

Income Tax

If you earn income from US sources, you’re generally required to file a US tax return and pay US income tax on that income. The US tax system takes into account factors like citizenship, residency, and the source of income. This means that even non-US citizens or non-residents may be subject to US taxation on specific types of income, such as rental income or wages earned while working in the US.

To determine your US tax obligations, various factors must be considered, including your residency status, the type of income earned, and any applicable tax treaties between Canada and the US. For instance, the US-Canada Tax Treaty provides guidelines for determining residency status and outlines the rules for claiming tax credits and deductions to avoid double taxation.

US Real Estate vs. Canadian Real Estate: Understanding the Differences

Market Size

The US real estate market boasts a significantly larger scale than its Canadian counterpart, presenting a multitude of investment opportunities. Valued at approximately $222.3 billion, the US real estate market outshines the Canadian market, which stands close to $63.74 billion.

Alternative Investment Options

When it comes to investing opportunities, the US real estate market has a wide range of options. Single-family houses, multi-family residences, commercial structures, and other options are available to investors. However, in Canada, investment opportunities are largely confined to residential properties.

Price Increases

Over time, the US real estate market has regularly outperformed its Canadian equivalent in terms of price appreciation. It is critical to remember that previous success does not predict future results.

Population Growth

With its larger population and higher population growth rate, the US experiences increased housing demand, which often translates into higher property values. In contrast, Canada’s population growth and size are relatively smaller.

Financing Options

In terms of financing, the US generally provides more favorable options compared to Canada. Private lenders are often willing to finance investment property purchases and negotiate terms and conditions for various mortgage options, including DSCR (Debt-Service Coverage Ratio) and Foreign National Loans. Unfortunately, this level of flexibility is not as readily available in Canada.

Tax Benefits

Real estate investors in the US enjoy a range of tax benefits, including deductions for mortgage interest and property taxes. Additionally, they have the option to elect Internal Revenue Code section 871(d), treating all income from US real property as connected to a business or trade in the US. While Canada also offers some tax benefits, they generally do not match the level of favorability found in the US.

Required Documents for Canadian Investors in US Real Estate

If you’re a Canadian looking to invest in US real estate, there are several important documents you’ll typically need to provide. These documents include:

- Passport: A copy of your passport is essential to verify your identity.

- Visa or Proof of Residency: Non-US citizens must furnish proof of their visa status or residency in the United States.

- Credit History: Depending on your situation, you may be asked to submit a credit report from your home country or an international credit agency. If you have a credit history in the US, it’s advisable to include a copy of your credit report.

- Proof of Income: Providing evidence of your income is crucial. This can be done through pay stubs, tax returns, or additional documentation for self-employed individuals, such as financial statements or bank statements.

- Down Payment: It’s necessary to demonstrate proof of funds to cover closing costs, down payments, and other associated expenses related to the property purchase.

- Property Information: You’ll need to furnish details about the property you’re intending to buy, including the purchase price, location, and property type.

- Other Documents: Depending on the lender and the type of loan, there may be additional documentation requirements, such as a letter of reference from a bank or a real estate agent.

By ensuring you have all the necessary documents readily available, you can streamline the investment process and increase your chances of success in the US real estate market.

How to Purchase US Real Estate as a Canadian: A Step-by-Step Guide

If you’re a Canadian interested in investing in US real estate, here’s a comprehensive guide to help you navigate the process smoothly

Obtain Financing

Start by deciding how you’ll finance your purchase. Options include:

- Securing a mortgage from a bank

- Obtaining financing from a US lender

- Using cash

Determine Your Budget

Once you’ve determined your financing method, establish your budget for the property. Consider the purchase price, closing costs, and ongoing expenses like insurance, property taxes, and maintenance.

Choose an Ideal Location

Research and identify the location where you want to invest. Explore the local market, analyzing factors such as property values, rental rates, and vacancy rates. For the best guidance, connect with experienced CIPS agents (Certified International Property Specialists) at no cost.

Hire an Experienced Real Estate Agent

Collaborate with a reputable real estate agent who specializes in working with Canadian buyers. They’ll assist you in navigating the US real estate market and guide you through the entire purchasing process.

Make an Offer

Once you’ve found a property that meets your criteria, it’s time to make an offer. Your real estate agent will assist you in drafting and submitting the offer.

Conduct a Thorough Home Inspection

Before closing on the property, perform due diligence by hiring a professional inspector and conducting a title search. This ensures there are no hidden issues or complications with the property.

Underwriting

Upon acceptance of your offer, your lender will initiate the underwriting process to approve your loan. Once approved, you can proceed to close on the property and take ownership.

Finalize the Deal

After completing due diligence, it’s time to close the deal. Rely on your CIPS agent and a lawyer to guide you through the process smoothly.

Property Management

If you plan to rent out the property, consider hiring a professional property manager to handle day-to-day operations such as tenant screening, rent collection, and maintenance.

Buying real estate in the United States as a Canadian can be a seamless and straightforward process. By following these steps and seeking guidance from experienced professionals, you can turn your dream of owning US real estate into a reality.

Essential Guidelines for Canadian Investors Buying US Real Estate at Auction

Purchasing US real estate at an auction presents an enticing opportunity for Canadian investors to acquire properties at lower prices compared to conventional methods. However, it’s crucial to comprehend the rules and associated risks before diving into the bidding process. Here are key considerations to keep in mind when buying US real estate at an auction

Thorough Property Research

Prior to placing a bid, conduct comprehensive research on the property and its history. This includes examining the title, identifying any liens or encumbrances, and inspecting the property for potential physical defects or other value-affecting issues.

Familiarize Yourself with the Auction Process

Each auction operates under its unique set of rules and procedures. Thus, it’s essential to gain a firm understanding of the specific auction process and bidding rules before participating.

Prepare Adequate Funds

Most auctions require a cash deposit or proof of financing at the time of bidding. Make sure to bring the necessary funds or required paperwork to actively participate in the auction.

Grasp the Bidding Process

Auctions can be fast-paced and highly competitive. Therefore, it’s imperative to acquaint yourself with the bidding process, enabling you to bid promptly and confidently when necessary.

Acknowledge the Competition

Expect the presence of other bidders, including seasoned investors armed with superior resources and knowledge. Stay mindful of the competition and be ready to adjust your strategy accordingly.

Comprehend the Sale

Terms In the event your bid emerges successful, you will be obligated to finalize the sale based on the auction’s specific terms. Therefore, it’s vital to understand these terms, including any associated fees or costs.

Seek Professional Guidance

Consulting with professionals, such as real estate attorneys or tax experts, is of utmost importance. They can provide valuable advice regarding the relevant laws and regulations specific to the state and local jurisdiction where the property is situated.

How to Finance Your US Real Estate Investment as a Canadian Investor

When it comes to financing your real estate purchase in the United States as a Canadian investor, you have several options at your disposal. Here are the key financing avenues to consider

Private Lender Loan

An alternative worth exploring is working with private lenders who specialize in financing foreign buyers. While they may offer more flexible terms, it’s important to note that the interest rates and fees may be higher. This option can be particularly appealing if you wish to bypass the arduous process of extensive paperwork and long waits for approval.

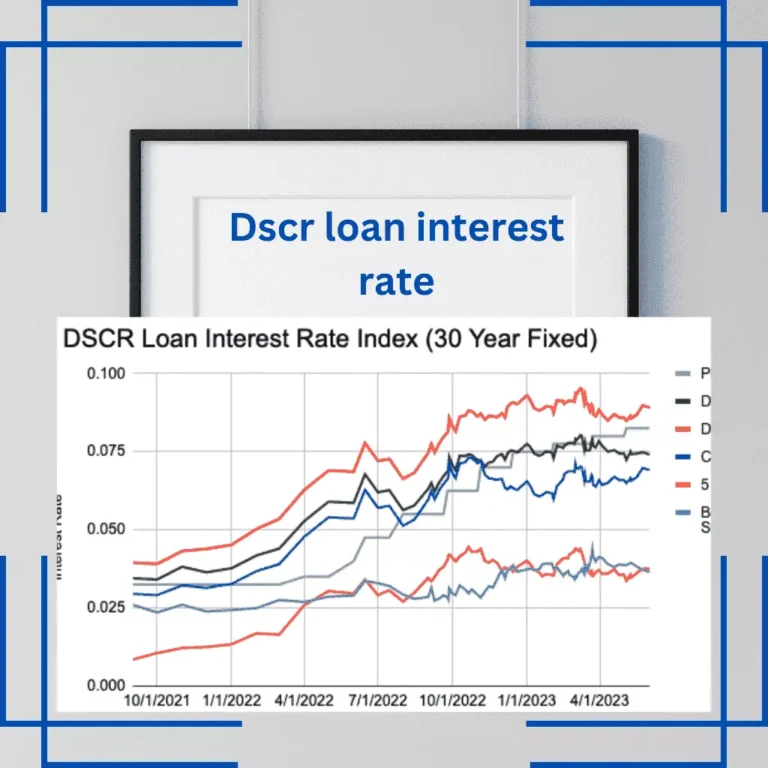

DSCR Loan

A DSCR (Debt Service Coverage Ratio) loan is granted based on the borrower’s ability to repay the loan. This type of loan is commonly utilized in commercial real estate, where the property generates income that can be used to meet the loan repayment requirements. Lenders typically expect a DSCR of 1 or higher for commercial real estate loans. This ensures that the property generates sufficient income to cover debt service payments and allows for unexpected expenses or vacancies.

Seller Financing

Another option to consider is negotiating with the seller for financing. This arrangement requires mutual agreement and usually entails a higher interest rate and a shorter repayment period.

As a Canadian investor venturing into US real estate, thorough research and consultation with a professional are essential to determine the financing option that suits your specific circumstances best.

Conclusion

In conclusion, investing in the US real estate market presents a wealth of opportunities for Canadian investors. With its robust economy, diverse investment options, and potential for higher returns, the US market offers an attractive destination for Canadians looking to diversify their portfolio and build equity.

![DSCR Loans in Michigan: Your Comprehensive Guide [2024]](https://loansformula.com/wp-content/uploads/2023/06/DSCR-Loans-in-Michigan-768x768.webp)