DSCR Commercial Real Estate Loan: An Ideal Choice For Investors

If you are thinking about investing in commercial real estate, you should examine a variety of things before making a decision. One of these factors is the Debt Service Coverage Ratio (DSCR) commercial real estate loan, an essential statistic used to assess a property’s ability to produce adequate cash flow to pay off its obligations.

Understanding the complexities of the DSCR commercial real estate loan might be difficult for beginners to the industry, but making educated investment decisions is critical. In this article, we will look at how the DSCR commercial real estate loan works and how it may help you make the best investment decision.

What is Debt Service Coverage Ratio (DSCR)?

Understanding the Debt Service Coverage Ratio (DSCR) is crucial when considering commercial real estate investments, and it also applies to residential properties. The DSCR commercial real estate loan metric measures the loan’s ability to generate sufficient cash flow to cover its debt obligations, encompassing both principal and interest payments.

To calculate the DSCR, you divide the property’s annual net operating income (NOI) by its annual debt service, which includes all the interest and principal payments associated with the loan.

In general, lenders prefer a DSCR of over 1 as a prerequisite for loan approval. This means that the borrower must generate more income than necessary to meet their loan obligations. A higher DSCR signifies that the loan performs well in relation to its debt burden, whereas a lower DSCR indicates that loan payments are relatively high compared to the property’s cash flow.

Example of DSCR Commercial Real Estate Loan

Let’s take a closer look at an example of DSCR in the context of commercial real estate:

Meet John, an investor with a keen interest in commercial real estate. He has set his sights on a specific commercial property priced at $2 million, which comes with a mortgage loan amounting to $1.5 million. The annual payments for principal and interest on this loan sum up to $90,000.

Now, the commercial property in question generates an annual net operating income (NOI) of $150,000. To assess the financial viability of this investment, John decides to calculate the Debt Service Coverage Ratio (DSCR). In this particular case, the resulting DSCR is 1.67x, surpassing the typical threshold of 1x set by commercial lenders.

Essentially, this means that John’s chosen commercial property carries a substantial loan but generates more income than required to cover its debt obligations. Consequently, John can confidently proceed with the investment, knowing that the property is likely to yield a positive return on his investment.

The Significance of DSCR in Commercial Real Estate Loan Applications

The Debt Service Coverage Ratio (DSCR) holds immense importance when assessing the viability of a loan. Consequently, lenders often set a minimum DSCR requirement as a prerequisite for loan approval.

When seeking a DSCR commercial real estate loan, it is crucial to carefully consider your operating expenses and debt obligations. This ensures that your income is sufficient to cover your debt payments while leaving you with additional funds.

It is equally important to remain vigilant about any potential changes in operating expenses or debt obligations that could impact your DSCR. An increase in either of these factors may lower your DSCR, thereby making it more challenging to obtain loan approval.

What are the DSCR Requirements for a Commercial Mortgage?

When it comes to commercial DSCR loans, lenders usually look for a Debt Service Coverage Ratio (DSCR) of 1 or higher. It’s important to note that different lenders may have varying requirements, so it’s always advisable to check with your specific lender before applying.

Moreover, if your property is situated in an area with high vacancy rates or experiences negative cash flow, you might be expected to meet lease payment obligations with a higher DSCR than the norm. Taking these factors into account can help you navigate the DSCR requirements and make informed decisions regarding your commercial mortgage.

What Lenders Consider When Assessing Loan Applications

When lenders evaluate loan applications, they take into account various factors, like

- Borrower’s credit score

- Cash flow

- Asset value

- Debt Service Coverage Ratio (DSCR)

Lenders carefully examine these factors to determine the borrower’s ability to repay the loan. Among these, the DSCR holds particular importance as it offers valuable insights into the property’s financial well-being and its ability to make consistent payments over time.

The DSCR plays a critical role in this evaluation by indicating the loan’s strength. Lenders want to ensure that borrowers can generate sufficient income to cover their annual debt payments.

Consequently, a higher DSCR signifies that a loan performs well relative to its debt obligations.

If you’re currently seeking a commercial lender, you may find it helpful to explore this informative article. It provides seven useful tips for finding the perfect lender who understands the significance of DSCR in commercial real estate.

What Types of Properties are Eligible for a DSCR Commercial Real Estate Loan?

When applying for such a mortgage, the property in question must demonstrate strong financial performance and generate sufficient cash flow to repay the loan.

Lenders commonly consider the following types of properties for DSCR commercial real estate mortgages:

- Multifamily properties, such as apartment buildings or townhouses, often have consistent rental income that can effectively support the debt service.

- Commercial property owners seeking loans should recognize the significance of DSCR commercial real estate mortgages and how lenders employ them to gauge financial performance.

- Office buildings or retail spaces typically have long-term leases with established tenants, providing stability and reliable cash flow.

- Rental properties, including single-family homes or commercial properties, often generate consistent rental income that can adequately support the debt service.

- Industrial properties, such as warehouses or manufacturing facilities, can produce steady cash flow through lease or rental income.

- Hotels or other hospitality properties often boast high occupancy rates and generate revenue through room rentals as well as food and beverage sales.

- Special-purpose properties, like healthcare facilities or educational institutions, may possess unique financial structures that necessitate a DSCR analysis.

To summarize, any property capable of generating sufficient cash flow to cover the monthly payments on a commercial real estate mortgage may be suitable for a DSCR loan. Lenders typically evaluate several factors, including the property type, occupancy rate, rental income, and financial history, to determine eligibility for these loans.

Steps to Obtain a DSCR Commercial Real Estate Loan

When it comes to securing a DSCR loan for a commercial property, there are several steps you need to follow. Here’s a breakdown of the process to help you navigate through it smoothly.

Determine Your Financing Needs

The first step is to assess and determine the amount of financing you require to fulfill your commercial real estate venture. Carefully evaluate your project’s scope and financial requirements before proceeding.

Prepare Your Financial Documents

Engage in a conversation with your lender to understand the specific documentation needed to apply for a DSCR loan. Gather all the necessary financial documents, including income statements, balance sheets, tax returns, and any other relevant paperwork.

Submit a Loan Application

Fill out a comprehensive loan application form provided by the DSCR lender. Include all the required documents as per their guidelines. This step marks the formal submission of your loan request.

Wait for Approval

After submitting your loan application, the lender will review your documents, rental schedule, creditworthiness, and Debt Service Coverage Ratio to evaluate your ability to repay the loan. This review process typically takes a few weeks. Be patient during this stage and remain in communication with the lender.

Negotiate Loan Terms

Once your loan application is approved, you will receive a set of loan conditions from the lender. These conditions may include interest rates, repayment periods, and collateral requirements. It is crucial to negotiate and discuss the terms provided to ensure they align with your specific needs and financial goals.

Finalize the Loan Agreement

After reaching an agreement on the loan terms, you will be required to sign the loan agreement and provide any additional documentation requested by the DSCR lender. This step formalizes the loan process and prepares for the disbursement of funds.

Receive Your Funds

Upon completing the loan agreement and fulfilling all necessary requirements, you will receive the approved funds to finance your commercial property. This injection of capital enables you to proceed with your real estate plans effectively.

By following these steps and understanding the process involved in obtaining a DSCR loan for commercial real estate, you can navigate the journey more confidently and increase the chances of securing the financing you need for your investment.

Comparing DSCR and LTV for Commercial Loans

When it comes to commercial loans, understanding the distinction between Debt Service Coverage Ratio (DSCR) and Loan-to-Value (LTV) is crucial. These two metrics are employed by lenders to evaluate loan applications, but they focus on different aspects of a commercial loan.

The DSCR provides insight into a borrower’s ability to generate sufficient income to cover their loan payments. On the other hand, the LTV calculates the proportion of a loan’s principal balance to the property’s value.

Lenders rely on both these metrics to assess the risk associated with a commercial loan application. By analyzing the DSCR and LTV, they can make more informed decisions regarding loan approval.

Comparing DSCR and Debt Yield: Evaluating Loan Risk in Commercial Real Estate

When it comes to assessing loan risk in commercial real estate, the Debt Service Coverage Ratio (DSCR) is not the only metric in the game. Another crucial factor considered by lenders is the debt yield, which measures the net operating income against the total debt payments.

Both DSCR and debt yield play a vital role in the evaluation of commercial loan applications.

The DSCR provides valuable insights into a borrower’s ability to generate sufficient income to cover their loan payments. On the other hand, the debt yield compares the net operating income to the principal and interest payments associated with the commercial loan.

In the assessment of a commercial real estate transaction, lenders typically take both metrics into account. By considering the DSCR and debt yield, they can determine the borrower’s eligibility for a mortgage loan. This comprehensive approach allows lenders to make informed decisions based on multiple factors, ensuring a thorough evaluation of loan risk in commercial real estate investments.

Calculation of Debt Service Coverage Ratio

To assess the financial viability of a commercial real estate loan, one important factor to consider is the Debt Service Coverage Ratio (DSCR). This ratio provides insights into a property’s ability to generate sufficient cash flow to meet its financial obligations. Let’s delve into the calculation process step-by-step.

Gather the Necessary Figures

To calculate the DSCR, you’ll need two key figures:

- Net Operating Income (NOI): This represents the total revenue generated by the property after subtracting operating expenses.

- Annual Debt Service (ADS): ADS refers to the genuine interest and principal payments due on the loan within a year.

Understanding the Formula

The DSCR formula is relatively straightforward. It involves dividing the NOI by the ADS. This calculation yields a ratio that indicates the available income for covering loan payments.

Explanation of Formula

The NOI reflects the property’s revenue after accounting for operating expenses. On the other hand, ADS represents the actual interest and principal payments due on the loan annually.

By dividing the NOI by the ADS, we arrive at the DSCR. This ratio serves as a measure of how much income is available to cover loan payments.

Interpreting the Results

A higher DSCR signifies that rental properties generate substantial cash flow, enabling them to comfortably manage their debt obligations. Conversely, a lower DSCR suggests that loan payments are relatively high compared to the property’s income, which may pose challenges in meeting financial responsibilities.

The Debt Service Coverage Ratio (DSCR) plays a crucial role in assessing the financial viability of a commercial real estate loan. By understanding and calculating this ratio accurately, investors can make informed decisions about their investment choices. Evaluating the DSCR provides valuable insights into the property’s cash flow and its ability to meet debt obligations effectively.

How DSCR Incorporates Loan Amount, Operating Income, and Loan Payments

Now, let’s delve into each factor individually to understand how the Debt Service Coverage Ratio (DSCR) takes them into account:

Loan Amount: A Crucial Input for DSCR Equation

The DSCR considers the loan amount as one of the two essential inputs in the equation, with the other being operating income. The loan amount plays a significant role in determining crucial aspects such as the interest rate, loan term, and ultimately, the loan payments.

Operating Income: Assessing Property Cash Flow

Operating income, another critical factor, is also considered in the DSCR equation. It serves as the numerator, reflecting the amount of cash flow generated by the property. This cash flow is a vital component in determining the property’s ability to meet its financial obligations.

Understanding the Equation’s Logic

For a loan to be considered healthy, the cash flow generated by the property should cover the loan payment. This logic is integral to the DSCR equation, as the loan payments serve as the denominator. By analyzing the relationship between the property’s operating income and the loan payments, lenders can evaluate how well the loan payments can be met using the property’s cash flow.

Incorporating these Factors for Informed Investment Decisions

By understanding how the DSCR accounts for loan amount, operating income, and loan payments, investors can make more informed decisions when considering commercial real estate investments. Evaluating the DSCR helps in assessing the property’s ability to generate sufficient cash flow to fulfill its financial obligations, providing crucial insights into the investment’s viability and potential returns.

Remember, a thorough understanding of the DSCR and its components is crucial for making well-informed investment choices in the commercial real estate sector.

Implications for Loan Applicants Based on the Calculated Figure

When a lender calculates a loan applicant’s Debt Service Coverage Ratio (DSCR), they assess the applicant’s ability to meet loan payments using the property’s generated cash flow. Consequently, loan applicants are more likely to receive approval if their loan exhibits a healthy DSCR of 1 or higher.

Conversely, a lower DSCR suggests that loan payments exceed the property’s cash flow, potentially requiring loan applicants to increase their down payment or restructure the loan terms to obtain approval.

Therefore, it is crucial for loan applicants to have a clear understanding of the DSCR and calculate their loan’s DSCR before applying for any loan.

What if the Loan Application Falls Short of the Lender’s Requirements?

When a loan application fails to meet a lender’s requirements, the lender has the option to either restructure or reject the loan.

In the case of restructuring, adjustments may be made such as extending the maximum loan term or increasing the down payment to meet the required Debt Service Coverage Ratio (DSCR). On the other hand, the loan will only be approved if the applicant meets these specific criteria.

The Implications of a Higher or Lower Debt Service Coverage Ratio for Loan Applicants

The Debt Service Coverage Ratio (DSCR) is a crucial metric that can greatly impact loan applicants in the commercial real estate market. It measures the property’s ability to generate enough cash flow to meet its debt obligations. Let’s explore what a higher or lower DSCR means for loan applicants and how it affects their chances of loan approval.

A higher DSCR signifies that the commercial property generates substantial cash flow, allowing for greater capacity to repay debt. This is a positive indicator as it demonstrates the property’s ability to cover loan payments comfortably. Consequently, loan applicants with a higher DSCR have a better chance of gaining approval for their loan, as they exhibit sufficient operating income to meet their debt obligations.

On the other hand, a lower DSCR suggests that the loan payments are relatively high compared to the property’s income. In such cases, loan applicants might face challenges in obtaining loan approval. To address this, they may need to consider increasing the down payment or exploring options to restructure the loan terms. These measures can help improve the DSCR, making it more favorable for loan approval.

Finally, a higher DSCR reflects a property’s strong cash flow and enhances the likelihood of loan approval, while a lower DSCR necessitates strategic adjustments to improve the chances of securing the desired loan. Understanding the significance of the DSCR and its impact on loan applications is essential for navigating the commercial real estate market effectively.

Factors to Consider When Applying for a DSCR Commercial Real Estate Loan

When applying for a DSCR commercial real estate loan, lenders take into account various statistical factors to assess the borrower’s ability to repay the loan on time. It’s essential to understand these factors and keep them in mind during the application process. Let’s explore some crucial considerations:

Debt Service Coverage Ratio (DSCR)

The DSCR measures the available income to cover debt payments. Lenders typically require a DSCR greater than 1, meaning that the property’s net operating income (NOI) must exceed the mortgage payment. A higher DSCR indicates a lower risk for lenders.

Loan-to-Value Ratio (LTV)

The LTV ratio compares the loan amount to the appraised value of the property. For commercial real estate loans, lenders generally prefer an LTV of 75% or lower. A lower LTV provides a cushion for the lender in case of default.

Property Type Lenders

Consider the type of property being financed and its potential for rental income. Properties with stable cash flows and high occupancy rates are more desirable. The property type can influence the lender’s assessment of risk and viability.

Market Conditions

The local real estate market and economic conditions also play a crucial role in evaluating the risk of a DSCR commercial real estate loan. Lenders examine market volatility and adjust their requirements accordingly. In a volatile market, lenders may require a higher DSCR or lower LTV to mitigate risks.

Overall, borrowers seeking a DSCR commercial real estate loan should present a robust financial profile, a viable business plan, and detailed financial projections. These factors enhance the likelihood of securing financing for commercial real estate projects.

By carefully considering these statistical factors and addressing them in your loan application, you can increase your chances of obtaining the necessary financing for your commercial real estate venture.

Tips to Increase Debt Service Coverage Ratio

The Debt Service Coverage Ratio (DSCR) is an important financial indicator that assesses a company’s capacity to repay its debts. Here are some helpful hints for increasing your DSCR:

Increase Revenue

Boosting your company’s revenue is one of the most effective ways to improve DSCR. By generating more money, you’ll have a larger cash flow available for debt service.

Reduce Expenses

Lowering your company’s expenses can also improve DSCR. This approach enhances the denominator and increases the ratio. Look for opportunities to cut unnecessary costs and make your business operations more efficient.

Manage Working Capital

Effective management of working capital is essential for meeting short-term financial needs. By efficiently handling cash flow, inventory, and accounts receivable, you can increase your cash reserves and enhance your ability to repay debt obligations.

Refinance your Debt

Consider refinancing your debt to increase your DSCR. By reducing the interest rate and extending the repayment term, refinancing lowers the total debt service requirement and improves the ratio.

Debt Reduction

Debt reduction is another way to increase DSCR. By lowering the overall amount of debt, you may raise the numerator and improve the DSCR.

Implementing these statistical suggestions will help your company’s DSCR and maintain financial stability in order to pay its annual debt commitments.

Factors Impacting the Debt Service Coverage Ratio (DSCR) for Commercial Real Estate Loans

The debt service coverage ratio (DSCR) serves as a vital metric used by lenders to assess loan applications, gauging borrowers’ ability to repay based on their income and expenses. The DSCR calculation can be influenced by various factors, including the loan amount, loan term, and loan type. Here’s a closer look at how these factors can impact the DSCR:

Loan Amount

The size of the loan has an inverse relationship with the DSCR. Larger loan amounts typically entail higher interest payments, which can increase the total debt service and lower the DSCR accordingly.

Loan Term

The duration of the loan also plays a role in the DSCR calculation. Longer loan terms result in interest payments being spread over a greater number of months, thereby reducing the total debt service and potentially yielding a higher DSCR.

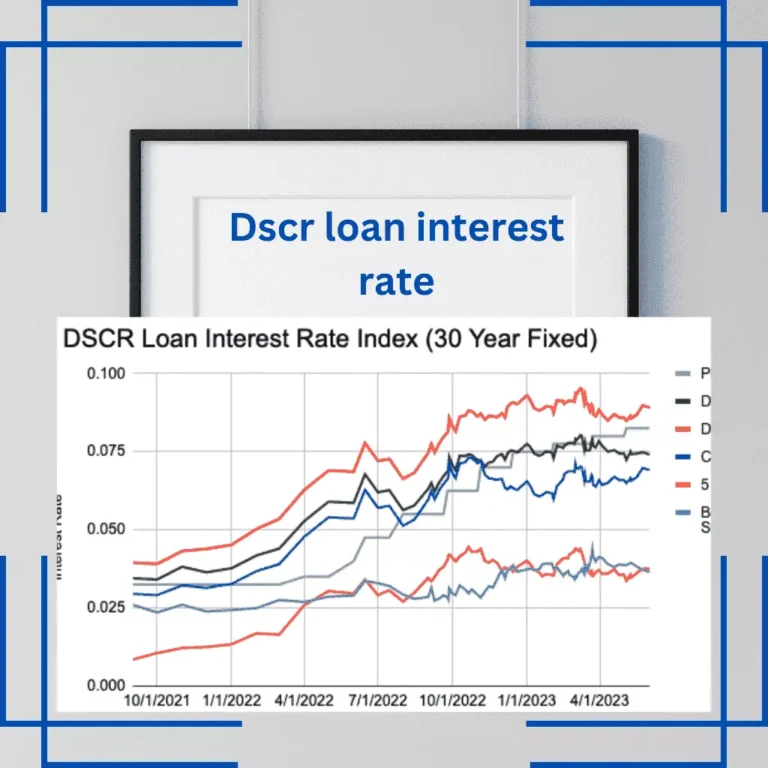

Interest Rate

The interest rate applied to the loan can affect the DSCR as well. Lower interest rates lead to reduced interest payments, thereby increasing the DSCR. Conversely, higher interest rates can have a detrimental impact on the DSCR.

Understanding the implications of loan amount, loan term, and interest rate when applying for a DSCR commercial real estate loan is crucial. To gain insights into DSCR loan interest rates and access lower rates, you can refer to our informative blog.

By comprehending these key factors, borrowers can make informed decisions regarding their financing options and enhance their chances of obtaining approval for a mortgage loan.

Conclusion

In conclusion, the Debt Service Coverage Ratio (DSCR) holds immense importance as a financial metric in commercial real estate transactions. Its purpose is to gauge a borrower’s capacity to fulfill their debt responsibilities, offering lenders crucial insights into the loan’s feasibility.

When borrowers take into account various factors, including loan amount, term, type, and property income, they can make well-informed decisions about their financing options. This, in turn, enhances their likelihood of securing loan approval.